Tired of lengthy trading challenges that delay your access to capital? This guide explains how instant funding prop firms offer a direct path for traders with a tested strategy, allowing you to bypass evaluations and start trading a funded account immediately. We'll cover how it works, the key rules to follow, and how to choose a reliable firm.

What is an Instant Funding Prop Firm?

An instant funding prop firm provides traders with immediate access to a simulated trading account in exchange for a one-time fee. Unlike traditional prop firms that require you to pass a multi-stage challenge over several weeks, this model lets you start trading and earning profit splits from day one. It's designed for traders who are confident in their strategy and don't need an evaluation period to prove their skills.

The concept is straightforward: if you have a consistently profitable strategy, you can pay for direct access to capital instead of spending time in a challenge. This model prioritizes speed and efficiency, removing the psychological pressure of meeting profit targets within tight deadlines.

How the Process Works: A 4-Step Guide

The process is built for simplicity, aiming to get you trading as quickly as possible.

- Choose Your Account Size: Select a simulated funding level that aligns with your strategy and risk tolerance, ranging from a few thousand dollars up to $100,000 or more.

- Pay the One-Time Fee: This single, upfront payment is your only financial risk. You cannot lose more than this fee.

- Receive Your Credentials: Once payment is confirmed, the firm will send your login details for a trading platform like DXtrade or cTrader.

- Start Trading: You can begin trading immediately, provided you adhere to the firm's risk management rules.

Disclaimer: Trading involves a substantial risk of loss and is not suitable for all investors. All trading activities within prop firm programs are conducted on simulated accounts. This content is for educational purposes only and is not financial advice.

Understanding the Core Rules: Drawdown Limits

While you get to skip the challenge, you don't get to skip the rules. Instant funding prop firms manage their risk by enforcing strict trading parameters, with drawdown limits being the most critical.

- Daily Drawdown: This is the maximum amount your account can lose in a single day, typically around 5%. On a $100,000 account, your equity cannot fall below $95,000 within that day.

- Maximum Drawdown: This is the total loss the account can sustain from its initial balance, often set at 10%. For a $100,000 account, if your equity ever drops below $90,000, the account is breached.

Staying within these boundaries is non-negotiable and requires disciplined risk management.

Instant Funding vs. Challenge Models at a Glance

So, how does this direct approach stack up against the more traditional 1-step or 2-step challenges? While both paths can lead to a funded account, they cater to very different trader mindsets and timelines. The challenge model is a structured test of skill over time, whereas the instant model is a direct entry point for those ready to perform immediately.

This table breaks down the core differences at a glance:

| Feature | Instant Funding Model | Challenge Model |

|---|---|---|

| Access to Capital | Immediate, upon payment of a fee. | Delayed, after passing 1 or 2 evaluation phases. |

| Upfront Cost | Typically higher one-time fee for direct access. | Lower initial fee, but may require retakes. |

| Evaluation Period | None. You start on a funded account immediately. | Can take several weeks or months to complete. |

| Psychological Pressure | Focused on managing a live-simulated account. | High pressure to meet profit targets within a time limit. |

| Profit Split | Starts from day one, often scales up with performance. | Begins only after passing the challenge. |

| Best For | Confident traders with a proven strategy. | Traders who want to test their strategy in a simulated environment before getting capital. |

Neither model is inherently "better"—they serve different needs. If you value speed and have confidence in your system, instant funding offers a clear advantage. If you prefer a lower-cost entry point to prove your abilities, a challenge might be a better fit.

Choosing Your Path: Instant Funding vs. A Challenge Account

Deciding between an instant funding program and a traditional challenge is a critical choice that should align with your trading style, confidence level, and risk management approach. An instant funding prop firm is ideal for traders with a proven, profitable strategy who want to bypass evaluations and start earning immediately. You pay a higher one-time fee but avoid the pressure of hitting profit targets on a deadline.

Challenge accounts act as a structured audition. The entry fee is lower, making it a suitable option for traders who want to validate their strategy under pressure before managing a larger simulated account. It's a methodical way to build confidence and prove you can adhere to risk rules.

To help you decide, consider the following points:

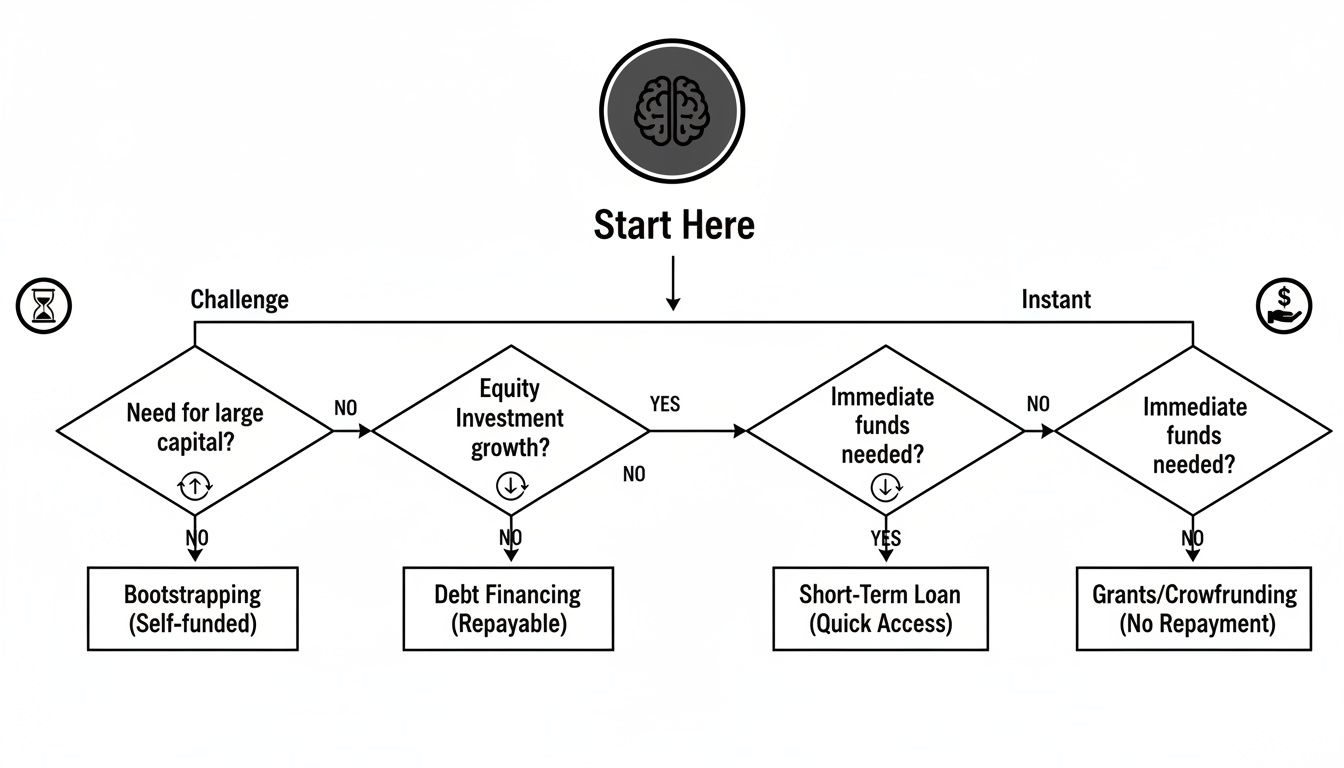

As the flowchart shows, your confidence in your strategy and your willingness to pay for immediate access are the key deciding factors.

The Challenge Model: A Test of Skill and Patience

Challenges are designed to identify traders who can generate profits while managing risk. They typically have one or two phases, each with a profit target (e.g., 8% in Phase 1) and strict drawdown rules.

While challenges are a good way to test your edge, the pass rates can be low. Industry data suggests that only 5-10% of traders pass initial evaluations, and an even smaller percentage receive a payout. This reality leads many experienced traders to prefer the directness of an instant funding prop firm.

The Instant Funding Model: For the Confident Trader

Instant funding is built for traders who have already done the work of back-testing and live-trading their strategy. For them, a challenge is an unnecessary delay.

Instant funding is a direct vote of confidence in your own ability. Instead of proving your strategy to the firm, you are backing yourself to perform from day one, turning your skills into potential earnings without the waiting period.

This model is a strong fit for:

- Systematic Traders: Those using EAs or algorithmic strategies with a proven track record.

- Experienced Day Traders: Veterans who know their edge and don't need a test to validate it.

- Low-Drawdown Strategists: Traders whose methods prioritize capital protection, making it easier to stay within risk limits.

By paying a higher fee, you are buying time and opportunity. If you're ready to start, exploring different funded forex trading accounts is the logical next step.

Navigating the Rules of Instant Funding Accounts

Securing an instant funded account is the first step; trading successfully within the firm's rules is the real challenge. These rules are a framework to protect the firm's capital and encourage disciplined trading. Mastering them is essential for a sustainable trading career.

Drawdown limits are the most critical rules. Breaching them typically results in the immediate closure of your account.

Demystifying Drawdown Limits

Drawdown rules are the foundation of risk management in proprietary trading.

- Daily Drawdown: This is the maximum loss your account can incur in a 24-hour period, usually around 5%, calculated from the balance or equity at the start of the day. For a $100,000 account, your equity cannot drop below $95,000.

- Maximum Drawdown: This is the total loss the account can sustain from its starting balance, often 10%. On a $100,000 account, if your equity ever falls below $90,000, the account is breached. This limit is typically fixed and does not trail your profits.

It's crucial to understand how these limits interact. A series of small losing days, while within the daily limit, can accumulate and breach the maximum drawdown. This highlights the importance of consistent, daily risk management.

Profit Splits and Payout Schedules

Once you are trading profitably while respecting the rules, you can earn a share of the profits. The profit split is the percentage of simulated profits you keep, which can be as high as 80-90%.

The payout schedule determines when you can withdraw your earnings.

- First Payout: You can typically request your first withdrawal 14 to 30 days after your first trade.

- Subsequent Payouts: After the first withdrawal, payouts often become available bi-weekly. Some firms offer weekly or on-demand withdrawals for consistent traders.

Always read the terms, as some firms may require you to hit a minimum profit target before requesting a withdrawal.

Other Important Trading Parameters

Beyond drawdown and payouts, other rules can affect your trading. These vary between firms, so due diligence is essential.

- Permitted Instruments: Most firms allow trading of major Forex pairs, indices, and commodities. Some, like MyFundedCapital, also offer cryptocurrencies.

- Leverage Limits: Leverage is usually capped to manage risk, with 1:100 being standard for FX pairs.

- News Trading: Trading during major news events can be restricted due to high volatility. Some firms prohibit it, while others allow it.

- Weekend Holding: Not all firms permit holding trades over the weekend. Check this if it's part of your strategy.

Breaking these rules can lead to a violation. Understanding what constitutes a hard breach rule is key to avoiding simple mistakes.

Why Instant Funding Is Gaining Momentum

The rise of instant funding prop firms is a direct response to trader demand for faster and more straightforward access to capital. Many traders view lengthy, multi-stage evaluations as unnecessary roadblocks, especially if they already possess a proven strategy. The industry evolved to meet this demand.

Who Is Driving the Demand?

The demand is primarily driven by experienced traders who find traditional challenges too rigid and time-consuming.

- Experienced Day Traders: These traders thrive on market momentum and need immediate access to capital to act on opportunities.

- Systematic EA Users: Traders using Expert Advisors (EAs) have often spent hundreds of hours back-testing. They have data-driven confidence in their systems and simply need capital to deploy them.

- Crypto Swing Traders: The fast-moving crypto market requires flexibility. Swing traders need the freedom to manage positions without being constrained by challenge rules.

The core appeal is efficiency. For a trader with a profitable system, every day spent in an evaluation is a day they aren't earning a potential profit split. Instant funding closes that gap, turning proven skill into immediate action.

A Response to a Booming Global Market

The demand for quicker funding reflects the explosive growth of proprietary trading worldwide.

According to industry data, global monthly search volume for 'prop firm' increased by 5,625% between January 2020 and June 2025. This surge aligns with the rise of models offering direct access to simulated accounts up to $100,000. The US led this trend with 9,900 monthly searches, followed by India (8,100) and Indonesia (3,600). You can review these prop firm statistics and their growth for more detail.

To serve this global audience, firms have adapted by offering flexible platforms like DXtrade and a wider range of assets. This solidifies the instant funding model's role in the industry by promising skilled traders: if you're ready, you can start now.

How to Choose the Right Instant Funding Prop Firm

The popularity of instant funding has led to a crowded market, making it difficult to distinguish reputable firms from unreliable ones. Choosing the right instant funding prop firm requires careful research to find a stable, transparent partner that fits your trading style.

This due diligence is more critical than ever after the industry's recent consolidation. In 2025, an estimated 80-100 firms closed due to unsustainable models, a shake-out that underscored the importance of stability and clear rules. You can read more about how 2025 reshaped the prop trading industry on Investing.com.

Your Due Diligence Checklist

Use this practical checklist to evaluate potential firms based on what truly matters.

1. Are the Rules Clear and Fair?

Vague rules are a major red flag. A trustworthy firm presents its terms and conditions clearly.

- Drawdown Rules: Ensure the daily and maximum drawdown limits are clearly defined. Understand whether they are calculated based on balance or equity.

- Realistic Limits: A 5% daily drawdown is standard. Assess whether the limits are compatible with your strategy or overly restrictive.

- The Fine Print: Look for hidden clauses regarding news trading, weekend positions, or specific strategies that could lead to an unexpected account termination.

Your goal is to find a firm whose rules fit your trading style like a glove, not one that forces you to abandon a working strategy just to stay compliant. If the rulebook feels confusing or overly restrictive, it’s a sign to move on.

2. Can You Trust Their Payouts?

A firm's reputation hinges on its ability to pay traders. Verify their track record before committing.

- Community Feedback: Check platforms like Trustpilot, Reddit, and Discord for genuine trader reviews and proof of payouts.

- Withdrawal Schedule: Look for clear payout schedules, such as bi-weekly or on-demand withdrawals.

- Payment Options: Confirm they offer convenient payment methods, such as bank transfers or crypto, that work in your location.

3. Is Their Tech and Support Solid?

A reliable platform and responsive customer support are non-negotiable.

- Trading Platforms: Look for firms offering well-known platforms like DXtrade or cTrader. Be cautious of proprietary software with no reputation.

- Customer Support: Test their support before you pay. Send specific questions via live chat or email to gauge their responsiveness and knowledge.

- Server Performance: Check reviews for feedback on execution speed, slippage, and server stability. A laggy platform can cost you money.

By focusing on these key areas, you can find an instant funding prop firm that will support your trading journey. For detailed comparisons, check our guide on the best instant funding prop firms.

Common Pitfalls to Avoid with Instant Funding

Receiving an instant funding account is an exciting milestone, but the real work begins now. Many skilled traders fail by falling into common mental and technical traps. Avoiding these pitfalls is key to long-term success.

The most common mistake is treating the funded account with less discipline than personal capital. Without the hurdle of a challenge, it's easy to develop a false sense of security and overuse leverage, leading to a quick breach of drawdown limits.

Think of your funded account as a high-performance tool, not a lottery ticket. Every single trade needs the same respect and risk management you'd use with your own hard-earned cash. We're aiming for long-term consistency, not one lucky home run.

Not Reading the Rules Carefully

Another frequent error is failing to fully understand the rules, particularly how drawdown is calculated. Traders often focus on the daily loss limit while neglecting the maximum drawdown. A series of small losses can accumulate and breach the total limit just as easily as a single large loss.

Confirm whether drawdown is based on your balance or equity, as this detail fundamentally changes how you must manage open positions.

Letting Emotions Drive Decisions

Instant funding replaces challenge pressure with the pressure to perform immediately. This can lead to destructive emotional trading habits.

- Revenge Trading: After a loss, avoid the impulse to immediately re-enter the market with a larger position to "win it back." This gambler's mindset almost always leads to further losses.

- Fear of Missing Out (FOMO): Don't force trades during large market moves if they don't align with your strategy. FOMO-driven decisions often ignore proper analysis and increase risk.

- Trading Without a Plan: The most significant error is trading without a well-defined, back-tested plan. A funded account amplifies your strategy; if your system is flawed, it will amplify your losses.

Treat this opportunity as a business from the moment you receive your login credentials. A clear plan, strict risk rules, and the discipline to follow them are essential for success.

Frequently Asked Questions

Here are answers to some common questions about using an instant funding prop firm.

Is instant funding legitimate?

Yes, instant funding is a legitimate model offered by reputable prop firms to identify skilled traders. Instead of a challenge, they use a live simulated account to evaluate your ability to trade profitably while adhering to their risk management rules. Since you are not investing your own capital to trade, it is a performance-based opportunity, not a financial investment.

Can I lose more than the one-time fee?

No. Your total financial risk is limited to the single fee you pay for the account. All simulated trading losses are absorbed by the firm, ensuring your personal finances are never at risk from market volatility. This allows you to trade with confidence within the firm's established parameters.

How quickly can I get my first payout?

Payouts with instant funding models are generally faster than with challenge accounts. At firms like MyFundedCapital, you can request your first payout just 14 days after placing your initial trade. After the first withdrawal, many firms offer even faster schedules, such as bi-weekly, weekly, or on-demand payouts.

Is instant funding suitable for beginners?

Instant funding is designed for traders who already have a proven, profitable strategy and strong risk management skills. Because you start trading a live simulated account immediately, there is no grace period to test your strategy under the firm's rules. New traders often find that a traditional challenge provides a more structured environment to see if their strategy is viable before managing a funded account.

Ready to skip the challenge and put your strategy to work? MyFundedCapital offers instant funding accounts with clear rules, high profit splits, and fast payouts. Explore our funding programs and find the right fit for your strategy today!