Finding a proprietary trading firm that is genuinely affordable can be a challenge, as the advertised fee is often just the beginning. This guide cuts through the marketing noise to analyze the truly cheapest prop firms, evaluating the total cost to get funded, not just the initial price. We will break down key factors like hidden fees, trading rules, and payout structures so you can make an informed decision.

1. MyFundedCapital

MyFundedCapital offers a combination of flexibility, speed, and trader-centric rules, making it a strong contender for one of the cheapest prop firms when considering the total package. The firm is a good fit for traders who prioritize fair conditions and the ability to customize their funding program to a specific strategy. Their standout feature is an Instant Funding program that bypasses the traditional evaluation process, allowing traders with a proven strategy to get immediate access to a simulated funded account.

Why MyFundedCapital Stands Out

MFC provides a modular and transparent approach where traders can choose from Instant, 1-Step, or 2-Step challenge paths and then add specific features. This ensures you only pay for what you need.

Key Features and Cost Factors:

- Flexible Funding Paths: Choose the entry model that best suits your confidence and budget. The 1-Step and 2-Step challenges offer lower entry costs, while Instant Funding provides immediate capital access.

- Transparent and Fair Rules: The firm uses straightforward risk parameters, with a consistent 5% daily drawdown and a clearly defined maximum drawdown (e.g., 6% for Instant Funding).

- Optional Add-Ons: Customize your account with upgrades that allow for weekend holding, news trading, and on-demand payouts. These features are useful for swing traders and news-based strategists.

- High Profit Splits: While the base profit split is competitive, add-ons can boost it to 90% or even 100%, allowing profitable traders to retain more of their earnings.

- Platform Support: Trade on DXtrade, cTrader, and Match-Trader, with MT5 integration planned. The firm also permits the use of Expert Advisors (EAs) and copy trading.

Practical Use Case: The Disciplined Day Trader

Consider a day trader specializing in indices who wants to trade during high-impact news events, which many low-cost firms prohibit. With MFC, the trader can select a challenge or Instant Funding account and purchase the "News Trading" add-on. This aligns the firm’s rules with their strategy.

Cost Structure and Value

While the base fee for a program like the $100K 1-Step Challenge is competitively priced, the real value comes from efficiency and customization. Faster access to payouts (weekly or on-demand with add-ons) improves a trader's cash flow. The upfront investment grants access to capital and a flexible infrastructure designed to support a trader's success.

Pros:

- Instant Funding Option: Skip the evaluation and start trading on a funded account.

- High Profit Splits: Keep up to 100% of your profits with available add-ons.

- Flexible Trading Conditions: Automated strategies, EAs, and copy trading are permitted.

- Customizable Features: Pay only for what you need, such as weekend holding.

- Transparent Rules: Clear drawdown rules help traders manage risk effectively.

Cons:

- Add-Ons Increase Total Cost: Features like news trading require additional investment.

- Simulated Accounts: All trading occurs on demo accounts, which may not perfectly replicate live market execution.

Website: https://dev.myfundedcapital.com

2. Apex Trader Funding

Apex Trader Funding specializes in the futures market and makes this list by offering some of the lowest entry costs available through frequent, aggressive promotional sales that can cut evaluation fees by 80-90%. This makes it a cost-effective choice for futures traders who are patient enough to wait for a deal. For example, a $25K evaluation account that normally costs $147 per month can drop to under $30 during these promotions.

Key Features and Cost Breakdown

Apex focuses exclusively on futures and supports popular platforms like NinjaTrader and TradingView via Rithmic or Tradovate connections.

- Evaluation Model: A simple one-step evaluation. You only need to hit the profit target without violating the trailing drawdown rule.

- No Daily Drawdown: Their standard "Full" accounts do not have a daily loss limit, only a trailing threshold, which provides more flexibility for managing intraday volatility.

- Payouts: After passing, traders can request payouts twice a month. The first $25,000 in profits are 100% yours, after which the split is 90/10.

The True Cost: Evaluation vs. Funded Account Fees

The low entry cost is the main draw, but it's important to understand post-evaluation fees. Once you pass and move to a Performance Account (PA), you must pay an activation fee. This can be a recurring monthly fee (e.g., $85 for a $50K account) or a one-time lifetime fee ($140 for a $50K account).

Actionable Tip: Always wait for a sale. Apex runs promotions almost constantly. Subscribing to their newsletter is the best way to catch an 80% or 90% discount code, which drastically reduces your initial cost.

Website: https://apextraderfunding.com

3. Topstep

Topstep is one of the original and most reputable firms in the futures prop trading space. While not always the absolute cheapest due to its focus on quality over aggressive promotions, its clear rules and established presence offer significant value. Topstep’s model is built on a monthly subscription fee for its Trading Combine. For example, their $50K account costs $165 per month until you pass.

Key Features and Cost Breakdown

Topstep provides a well-documented and educational environment. The Trading Combine is a two-step process designed to assess a trader's skill and risk management.

- Evaluation Model: A clear, two-step Trading Combine. Step 1 requires hitting a profit target, and Step 2 confirms consistency.

- Transparent Rules: The platform is known for its straightforward rules, including a Maximum Loss Limit and a Daily Loss Limit that are easy to track.

- Platform Flexibility: Supports a wide range of futures platforms, including NinjaTrader, TradingView, and Quantower.

- Payouts: Once funded, traders keep 100% of their first $5,000 to $10,000 in profits (depending on promotions) and 90% thereafter.

The True Cost: Subscription vs. Funded Account Fees

The primary cost is the monthly subscription for the Trading Combine. Once you pass, there is a one-time activation fee of $149 for all account sizes to get started in the Express Funded Account.

Actionable Tip: While Topstep doesn't run frequent 90% off sales, they do offer regular promotions. Look for discounts on the monthly fee or offers that waive the activation fee upon passing.

Website: https://www.topstep.com

4. Bulenox

Bulenox is another futures firm that makes the list of cheapest prop firms by using a high-discount promotional model. It targets budget-conscious traders with coupons that often slash evaluation fees by 45% to over 90%. For example, a $25K account that normally costs $145 per month can be bought for less than $30 during a sale, making it an accessible option.

Key Features and Cost Breakdown

Bulenox offers a streamlined, futures-only trading environment with a clear one-step evaluation process. A free NinjaTrader license and market data are included during the evaluation, which adds significant value.

- Flexible Account Rules: Traders can choose between two main account types: one with a straightforward trailing drawdown and another with an End-of-Day (EOD) drawdown and a scaling plan.

- No Scaling on Master Accounts: Once funded, there are no scaling plan restrictions, giving you full access to the account's contract limits.

- Generous Payouts: The first $10,000 in profits are 100% the trader's. After that, the profit split is 90/10.

The True Cost: Evaluation vs. Funded Account Fees

After passing, you must pay a one-time activation fee to activate a funded Master Account, which varies by account size (e.g., $148 for a $50K account). This single payment covers lifetime access.

Actionable Tip: Never pay the full price for a Bulenox evaluation. Follow their social media or check their website for the latest 80%+ discount code to ensure you get the lowest possible entry fee.

Website: https://bulenox.com

5. FundedNext

FundedNext offers a diverse set of evaluation models with low entry fees, particularly for U.S. traders. The firm provides one-step, two-step, and a simplified "Stellar Lite" option. Combined with a policy of refunding the evaluation fee upon the first payout, it's an attractive, low-risk starting point. The Stellar Lite challenge for a $6K account can be accessed for as little as $32.

Key Features and Cost Breakdown

FundedNext provides access to Forex, indices, and commodities, guiding U.S. users toward the Match-Trader platform to ensure compliance and availability.

- Multiple Evaluation Models: Choose from a 1-Step challenge, a standard 2-Step challenge, or the low-cost Stellar Lite model.

- No Recurring Fees: FundedNext uses a one-time payment model for evaluations, and the fee is reimbursed with the first successful profit split.

- High Profit Splits: Offers a profit share of up to 90%, which can be boosted to 95% with an add-on purchase.

The True Cost: Evaluation vs. Platform Fees

The upfront cost is low, and the fee refund is a significant benefit. However, be mindful of potential platform-related costs and research community feedback, as some users have reported disputes. Performing due diligence is crucial.

Actionable Tip: If you are a U.S. trader, focus on the Match-Trader options to ensure the smoothest experience and access the lowest-priced challenges. The Stellar Lite model is an excellent, low-cost way to test their systems.

Website: https://fundednext.com

6. Funding Pips

Funding Pips focuses on extremely low, one-time evaluation fees for forex and CFD traders. Their model is built around rock-bottom standard pricing, making it an attractive entry point for traders who want to minimize initial risk without waiting for a promotion. A two-step $10,000 evaluation can often be found for around $60-$66, positioning Funding Pips as a primary choice for traders prioritizing low cost.

Key Features and Cost Breakdown

Funding Pips offers one-step, two-step, and instant funding programs. For U.S.-based traders, the firm provides access to platforms like Match-Trader and TradeLocker.

- Ultra-Low One-Time Fees: The core appeal is the single, non-recurring fee for evaluations, which is among the lowest in the industry.

- Multiple Challenge Types: Traders can choose from several evaluation formats to control their qualification process.

- Modern Platform Support: The inclusion of Match-Trader and TradeLocker provides robust, user-friendly alternatives where MT5/cTrader access may be limited.

- Wide Range of Account Sizes: Accounts are available from $5,000 up to $100,000.

The True Cost: Evaluation vs. Reputation

The transparent, low-cost entry is a major advantage. Once a trader passes, they gain access to a funded account without further activation fees. However, community feedback on the firm is mixed, with some users reporting issues related to rule enforcement and trade execution.

Actionable Tip: Before committing, research recent user reviews on platforms like Trustpilot or Reddit. While the entry cost is minimal, understanding the experiences of other funded traders can help set realistic expectations.

Website: https://fundingpips.com

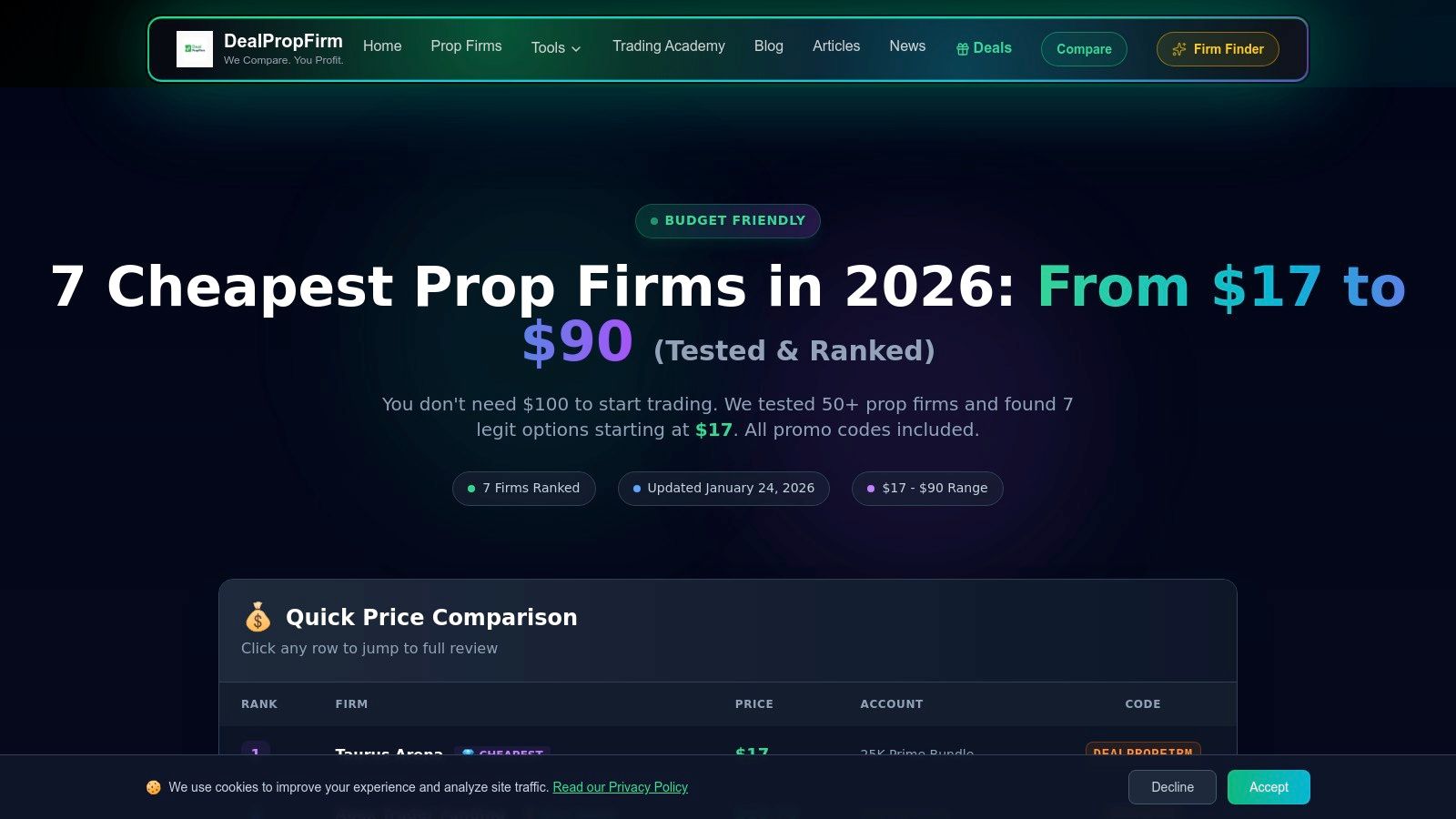

7. DealPropFirm (Cheapest Prop Firms comparison hub)

DealPropFirm is not a prop firm but a valuable resource. It's a U.S.-based comparison and deals aggregator designed to help traders find the cheapest prop firms available at any moment. The site functions as a centralized hub, maintaining an updated list of the best deals with verified promo codes.

Its core value is tracking the aggressive, short-term promotions that firms like Apex Trader Funding and Bulenox are famous for. Instead of monitoring multiple sites, DealPropFirm presents the current lowest-entry deals in one place.

Key Features and Cost Breakdown

The platform's main purpose is to provide transparency on effective entry costs.

- Live Rankings: The site maintains a constantly updated ranking of the cheapest prop firm evaluations.

- Verified Promo Codes: It aggregates and verifies coupon codes to ensure traders get the maximum possible discount.

- Editorial Notes: The site includes brief notes that flag potential risks or highlight problematic terms associated with certain firms.

- Useful Tools: It also hosts practical tools like risk/profit calculators and a challenge simulator.

The True Cost: A Starting Point for Research

DealPropFirm excels at finding the lowest entry point, but it should be the beginning of your research, not the end. Always cross-reference the terms, rules, and post-evaluation fees on the prop firm's official website before making a decision.

Actionable Tip: Bookmark the "Cheapest Prop Firms" page on DealPropFirm and check it before you purchase any evaluation. Flash sales can appear and disappear quickly, and this site is one of the best ways to catch them.

Website: https://dealpropfirm.com/best/cheapest-prop-firms

Making Your Choice: Beyond the Price Tag

Finding the cheapest prop firms requires looking beyond the initial challenge fee. The true value lies in the combination of rules, support, and alignment with your trading strategy. The goal is not just to get funded but to stay funded and consistently withdraw profits. A firm with a slightly higher evaluation fee but more forgiving drawdown rules or faster payouts might offer better long-term value.

A Final Checklist for Choosing Your Prop Firm

Before you commit, run your top choices through this checklist:

- Calculate the "True Cost": Look past the headline number. Factor in monthly fees, reset fees, and platform costs. A $99 challenge with a high reset fee can become more expensive than a $150 challenge.

- Match Rules to Your Strategy:

- News Traders: Is news trading permitted?

- Swing Traders: Can you hold trades over the weekend? Many successful strategies require this, and you can find actionable swing trader tips to improve consistency.

- Algo/EA Traders: Does the firm explicitly support automated trading?

- Analyze the Drawdown Model: Do you prefer a static, trailing, or daily loss limit? Understand exactly how the drawdown is calculated, as this is the most common reason traders fail challenges.

- Confirm Payout Policies: Prioritize firms with clear, reliable payout schedules and confirm the minimum withdrawal amounts.

The best prop firm isn't the one with the lowest price; it's the one that offers the most direct and sustainable path to profitability for your unique trading style.

Frequently Asked Questions (FAQ)

1. Are the cheapest prop firms legitimate?

Yes, many low-cost prop firms are legitimate businesses. However, "cheap" can sometimes come with trade-offs like stricter rules, less responsive customer support, or slower payouts. It's crucial to research each firm's reputation and read recent user reviews before signing up. The firms on this list are established, but always perform your own due diligence.

2. What is the difference between a one-step and two-step evaluation?

A one-step evaluation requires you to meet a single profit target without violating any rules (like maximum drawdown). A two-step evaluation involves two phases, usually with a lower profit target in each phase. One-step challenges are faster but often have higher profit targets or tighter drawdown limits, while two-step challenges are more standard but take longer to complete.

3. Do I need to pay taxes on prop firm profits?

Yes. In most jurisdictions, profits from prop firm trading are considered income. Funded traders typically operate as independent contractors and are responsible for reporting their earnings and paying the appropriate taxes. It is highly recommended to consult with a tax professional in your country to understand your specific obligations.

Start Your Funding Journey

Choosing the right prop firm is about finding the optimal balance of affordability and opportunity. Use the insights from this guide to look beyond the price tag and select a partner that empowers your trading. Trading involves significant risk of loss and is not suitable for all investors. This content is for educational purposes only and is not financial advice.

Ready to find a funding program that balances aggressive payouts with trader-friendly rules? Explore our programs at MyFundedCapital and see how our structure can support your path to becoming a funded trader.