Struggling with a small trading account and wondering how to access more capital without risking your savings? Funded forex trading accounts offer a solution, but they come with strict rules. This guide explains how they work, how to pass the evaluation, and what to look for in a prop firm.

What Are Funded Forex Trading Accounts?

A funded forex trading account is an arrangement where a proprietary trading firm (prop firm) provides you with capital to trade. You pay a one-time fee to take an evaluation or "challenge." If you pass by proving you can trade profitably and manage risk, the firm gives you a funded account to manage.

This is a performance-based partnership. The trader gets access to significant capital (e.g., $10,000 to $200,000+) without risking personal funds, and the firm profits by taking a small share of the earnings. Trading involves a substantial risk of loss and is not suitable for every investor. This content is for educational purposes only and is not financial advice.

How the Partnership Works

The model is straightforward: prove your skill, and a firm will back you. Once you pass a challenge, you start trading the firm's capital and share the profits.

Key benefits for a trader include:

- Access to Capital: Trade with a $50,000 or $100,000 account, an amount most retail traders don't have.

- No Personal Capital Risk: Beyond the evaluation fee, your personal savings are not at risk from trading losses. The firm absorbs them.

- High Profit Splits: Successful traders typically keep 80% to 90% of the profits they generate.

This model levels the playing field. It shifts the focus from the size of your bank account to the quality of your trading strategy. A funded account provides the leverage to turn a proven skill into a potential career.

The popularity of this model has grown significantly, leading to more competition among prop firms. This has resulted in better terms, more flexible rules, and higher profit shares for disciplined traders. You can find more insights about the growth of funded trading from industry analysis.

How to Qualify for a Funded Account

Getting a funded account isn't as simple as just asking. Prop firms need proof that you can trade responsibly before handing over their capital. The qualification process is designed to test your skills under realistic market conditions.

The most common paths are Instant Funding, 1-Step Challenges, and 2-Step Challenges. Understanding the differences is the first step toward choosing the right path for your trading style.

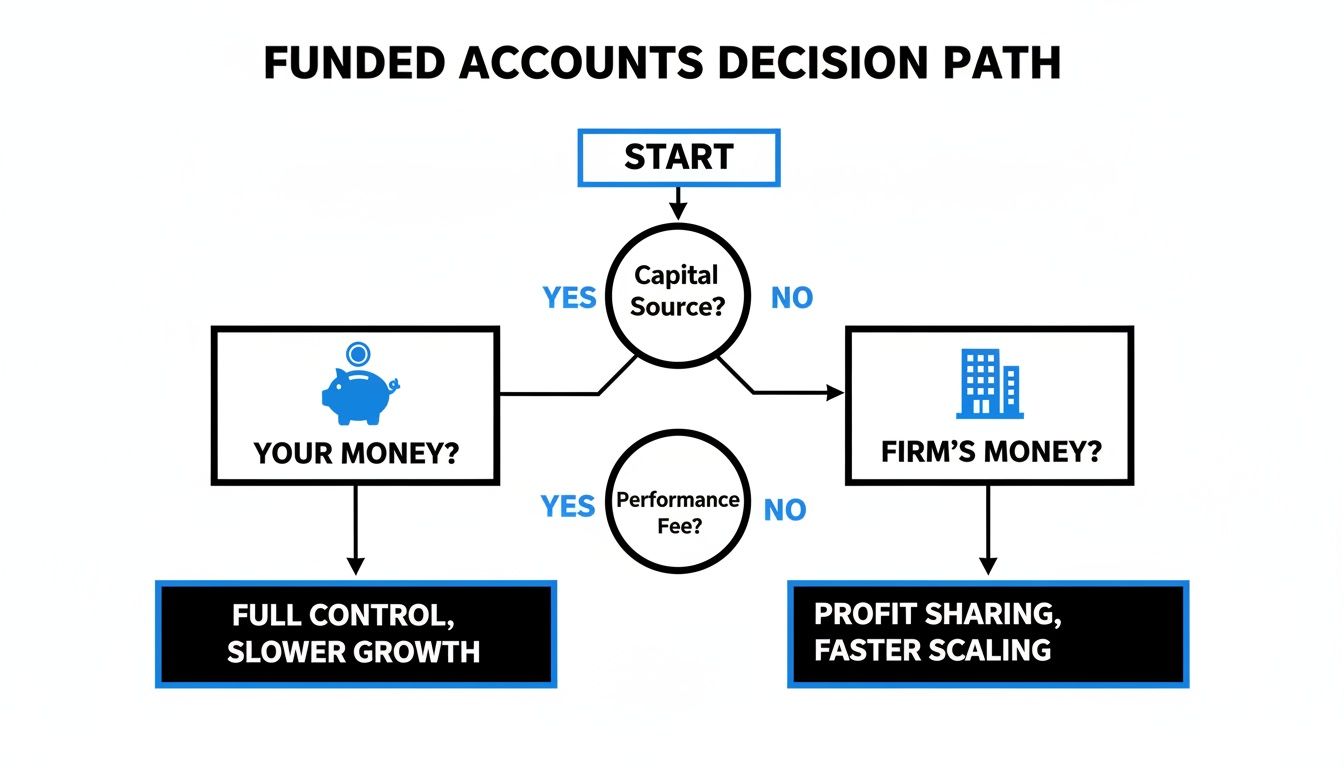

This flowchart illustrates the core decision: trading your own money versus a firm's capital.

The trade-off is clear: using your own capital means 100% risk and 100% reward. With a prop firm, you limit financial risk to the challenge fee but share a portion of your profits.

The Instant Funding Model

The Instant Funding model is the most direct route. You pay a fee and get immediate access to a funded account with no evaluation phase. This is best suited for experienced traders with a consistently profitable track record who want to start earning immediately.

However, this speed comes with conditions:

- Tighter Drawdown Limits: The maximum loss allowed is often smaller than in challenge accounts. For example, a 6% max drawdown instead of 10%.

- Slower Scaling: You typically start with a smaller account and must prove profitability over time to get more capital.

- Lower Initial Profit Splits: The firm may offer a lower profit share initially (e.g., 70%) until you demonstrate consistent performance.

The 1-Step Challenge Model

The 1-Step Challenge is a middle-ground option. It requires passing a single evaluation phase where you must hit a specific profit target, typically 10%, without violating any risk rules. Most 1-step challenges have no time limits, which reduces psychological pressure.

The 1-Step Challenge is a direct test: can you generate a solid return while respecting risk parameters? It's an efficient way to demonstrate your skill.

Once you hit the profit target, you receive your funded account. This model is a great fit for consistent traders who prefer a single, clear objective. For more details on preparing, check out our guide on how to obtain a forex funded account.

The 2-Step Challenge Model

The 2-Step Challenge is the industry standard. It breaks the evaluation into two phases, giving the firm a comprehensive look at your profitability and consistency.

- Phase 1 (The Test): Hit a profit target of around 8% to 10% while adhering to daily and maximum drawdown rules.

- Phase 2 (The Verification): Hit a lower profit target, usually 5%, with the same risk rules. This phase confirms your initial success wasn't due to luck.

Passing both phases demonstrates that you can not only find profitable trades but also protect capital consistently.

Comparison of Prop Firm Funding Models

Choosing the right model depends on your experience, trading style, and how you handle pressure. This table breaks down the key differences.

| Model Type | Best For | Key Advantage | Common Challenge |

|---|---|---|---|

| Instant Funding | Confident, experienced traders who want to earn immediately. | Immediate access to a profit-generating account. | Tighter risk rules and slower scaling potential. |

| 1-Step Challenge | Consistent traders who want a direct but fair evaluation. | A single, clear objective without multiple phases. | The profit target can be higher than in 2-step models. |

| 2-Step Challenge | Methodical traders who want the industry-standard path. | Lower profit targets per phase, allowing for a more patient approach. | The process takes longer and requires sustained consistency. |

There is no "best" model—only the one that aligns with your strategy and goals.

Understanding the Core Rules of Funded Trading

To succeed with funded forex trading accounts, you must treat the rules as your professional risk management framework. They are not designed to make you fail; they are there to protect the firm's capital and instill discipline. Mastering these rules is what separates successful funded traders from the rest.

The Drawdown Rules Explained

Drawdown is the most critical rule. It measures the reduction in your account's equity from its peak. Violating a drawdown rule is the quickest way to lose your account. There are two types to monitor constantly.

- Daily Drawdown: This caps your maximum loss within a single day, typically 5% of the starting balance.

- Maximum Drawdown: This is the total loss limit for the account, usually between 8% and 12%.

Daily Drawdown in Action

The daily drawdown prevents a single bad day from wiping out your progress. It's calculated based on your account balance at the start of the trading day (5 PM EST).

Example:

- Account Size: $100,000

- Daily Drawdown Limit: 5% ($5,000)

- Your account equity cannot drop below $95,000 at any point during the day. If it touches $94,999, even for a moment from an open position's floating loss, you have breached the rule.

Crucial Point: This rule applies to your account equity (balance plus or minus open profits/losses), not just your closed balance.

Understanding Maximum Drawdown

The maximum drawdown is the ultimate safety net. It can be static or trailing.

- Static Drawdown: This is a fixed value based on your initial balance. On a $100,000 account with a 10% static drawdown, your equity can never fall below $90,000. It doesn't change even if your account grows.

- Trailing Drawdown: This is more dynamic and adjusts as your account balance reaches new highs. If your $100,000 account has a 10% trailing drawdown and you grow it to a new high of $105,000, your new drawdown floor becomes $94,500 ($105,000 – $10,500). It "trails" your highest equity point.

It is critical to know which drawdown type a firm uses. A trailing drawdown requires more active management of open profits. You can learn more about how to calculate maximum trailing drawdown in our FAQ.

Other Common Trading Guidelines

Beyond drawdown, other rules may apply. Always read a firm's terms and conditions carefully.

- News Trading Restrictions: Some firms restrict trading around major economic news releases (e.g., NFP, CPI) due to extreme volatility. If your strategy relies on news, find a firm that allows it.

- Weekend Holding: To avoid the risk of large weekend gaps, many firms require all positions to be closed by Friday afternoon. This is a critical consideration for swing traders.

- Profit Targets: During the challenge, you must meet a specific profit target (e.g., 8% in Phase 1, 5% in Phase 2) to pass.

How to Prepare for and Pass a Funding Challenge

Passing a funding challenge requires preparation, discipline, and a professional mindset. It's a test of skill, not a lottery ticket. These practical steps will increase your chances of getting funded.

Step 1: Validate Your Strategy Before Paying

Do not use a challenge to test a new strategy. Before paying the fee, you must have a trading plan that is thoroughly backtested and, more importantly, forward-tested on a demo account. You need to know your numbers cold.

Checklist:

- Win Rate: What percentage of your trades are profitable?

- Risk-to-Reward Ratio: Is your average winner larger than your average loser (e.g., 1:2 R:R)?

- Maximum Historical Drawdown: If your strategy has experienced a 15% drawdown in backtesting, it is not suitable for a firm with a 10% maximum drawdown rule.

Step 2: Choose a Psychologically Sound Account Size

Don't let ego drive your decision. Starting with a $200,000 challenge when you are used to a $1,000 account can be psychologically overwhelming. The position sizes and potential floating losses can trigger emotional decisions. Start with an account size that feels manageable. A $25,000 funded account you pass is better than a $200,000 account you lose.

Step 3: Focus on Risk Management, Not Profit Targets

This is the most critical mindset shift. Your primary goal during a challenge is not to hit the profit target; it is to avoid hitting the drawdown limit. If you protect your capital, the profits will take care of themselves.

During an evaluation, you are a risk manager first and a trader second. Every trade should start with the question, "How much am I prepared to lose on this idea?"

Aim for small, consistent gains. A series of 0.5% winning trades is a much safer path to the target than attempting a single high-risk trade. Keep your risk per trade between 0.5% and 1% of the account balance.

Step 4: Understand the Reality of Pass Rates

It's important to be realistic. Most traders fail their challenges. Industry data suggests pass rates for initial evaluations are between 5% and 15%. These numbers aren't meant to discourage you; they highlight the need for discipline and preparation. Choosing a firm with trader-friendly rules, like no time limits, can reduce the pressure that leads to mistakes. For more data, see these reports on prop firm pass rates at FinanceMagnates.

Step 5: Keep a Detailed Trading Journal

Journal every trade throughout the challenge. Document the setup, entry, exit, the reason for the trade, and your emotional state. A journal is an essential tool for objective self-assessment.

It helps you:

- Identify and correct recurring mistakes.

- Recognize emotional patterns like revenge trading.

- Refine your strategy based on performance data.

Choosing the Right Prop Firm for Your Strategy

Selecting a prop firm is a crucial decision. It's easy to be swayed by large account sizes and marketing hype. The goal is to find a firm whose rules and structure are compatible with your specific trading strategy. A firm that is perfect for a scalper could be unsuitable for a swing trader.

Key Factors to Evaluate in a Prop Firm

Use this checklist to conduct your due diligence before paying for a challenge.

- Reputation and Payouts: Look beyond the Trustpilot score. Search for reviews discussing timely payouts and customer support. A firm's reputation for paying traders consistently is non-negotiable.

- Trading Rules and Flexibility: Do the rules align with your strategy? If you are a news trader, you need a firm that allows it. If you are a swing trader, you must choose a firm that permits holding trades over the weekend.

- Drawdown Type: Is the maximum drawdown static or trailing? A static drawdown is simpler to manage, while a trailing drawdown requires more careful monitoring of open profits.

- Trading Platforms and Instruments: Ensure the firm offers a platform you are comfortable with (e.g., cTrader, DXtrade) and the specific assets you trade (e.g., specific forex pairs, indices, or crypto).

Payouts and Support Systems

A firm is only as good as its payout process. Investigate how often you can request withdrawals (e.g., weekly, bi-weekly) and what payment methods are available. A clear and reliable payout system is a sign of a trustworthy firm.

A prop firm's true value is revealed when you need support or a payout. Reliable withdrawals and responsive customer service are the foundations of a healthy long-term partnership.

Finally, evaluate their support. Can you get a quick response from a real person if you have a technical issue? Firms that invest in quality, accessible support demonstrate a commitment to their traders' success. For a detailed comparison, see our list of funded prop firms in 2024.

Life After You Get Funded

Passing the challenge is a significant accomplishment, but it's the beginning, not the end. The real work starts now. Your focus shifts from passing a test to generating consistent income and growing your account.

Cashing In Your Profits: Payouts

Once you are profitable on your funded account, you can request a payout. The profits are divided based on a pre-agreed profit split. A common split is 80/20, meaning you receive 80% of the profits.

Payout schedules vary by firm:

- Bi-weekly Payouts: Request a withdrawal every 14 days.

- Weekly Payouts: Withdrawals can be requested every 7 days.

- On-Demand: Some firms allow you to request your first payout as soon as you are in profit.

The process is typically handled through your trader dashboard, with funds sent via bank transfer or crypto.

Growing Your Capital: Scaling Plans

The most powerful feature of a funded account is the scaling plan. This is how a firm rewards consistent traders by increasing their account size.

Think of it as a career promotion. If you consistently hit profit targets (e.g., 10% profit over 3 months) on a $50,000 account, the firm might "promote" you to a $100,000 account, then $200,000, and beyond.

Scaling dramatically increases your earning potential. A 2% monthly gain on a $50,000 account is $1,000 (your share: $800). That same 2% on a scaled $400,000 account is $8,000 (your share: $6,400). Your strategy remains the same, but your income potential grows exponentially without any additional personal risk. To understand more, learn more about how funded capital impacts trader profitability.

Frequently Asked Questions (FAQ)

Are funded forex trading accounts legitimate?

Yes, the funded trader model is a legitimate business model used by many reputable proprietary trading firms. However, like any industry, it has its share of unreliable operators. It is crucial to conduct thorough due diligence and choose a firm with a strong reputation, transparent rules, and a proven track record of paying its traders. Always be wary of firms that promise guaranteed profits or have unclear terms.

How much does a funded account cost?

You do not pay for the funded account itself. You pay a one-time, refundable fee for the evaluation or challenge. The cost depends on the account size you choose. For example, a $25,000 challenge might cost around $150, while a $100,000 challenge could be around $500. If you pass the challenge, this fee is typically refunded with your first profit payout.

What happens if I fail the challenge?

If you violate a rule (like the maximum drawdown) during the challenge, the account is closed, and you forfeit the fee. You do not owe the firm any money for the losses incurred. Most firms allow you to purchase a new challenge at any time, often with a discount, to try again. Failing is a common part of the process and should be treated as a learning experience.

Ready to prove your trading skills and access the capital you need to succeed? At MyFundedCapital, we provide clear rules, flexible account types, and reliable payouts.

Compare our flexible account types and start your challenge today!