Calculating your trade size is one of the most critical steps in trading, yet many beginners guess or use a random number. This approach is a fast track to draining your account, as it ignores the most important factor: risk. This guide will show you how to use a lot size calculator to define your exact risk on every trade, a non-negotiable skill for long-term survival in the markets.

Why Position Sizing is a Critical Trading Skill

Effective risk management is the foundation of any successful trading career, and position sizing is how you put that management into practice. It's the practical step that connects your trading plan to the actual volume you trade. Frankly, it's what separates professional traders from gamblers.

Instead of just picking a lot size and hoping for the best, you start by deciding exactly how much of your account you are willing to lose if the trade fails. This simple shift in process has a massive impact on your trading psychology and account longevity. It forces you to manage risk proactively, not reactively.

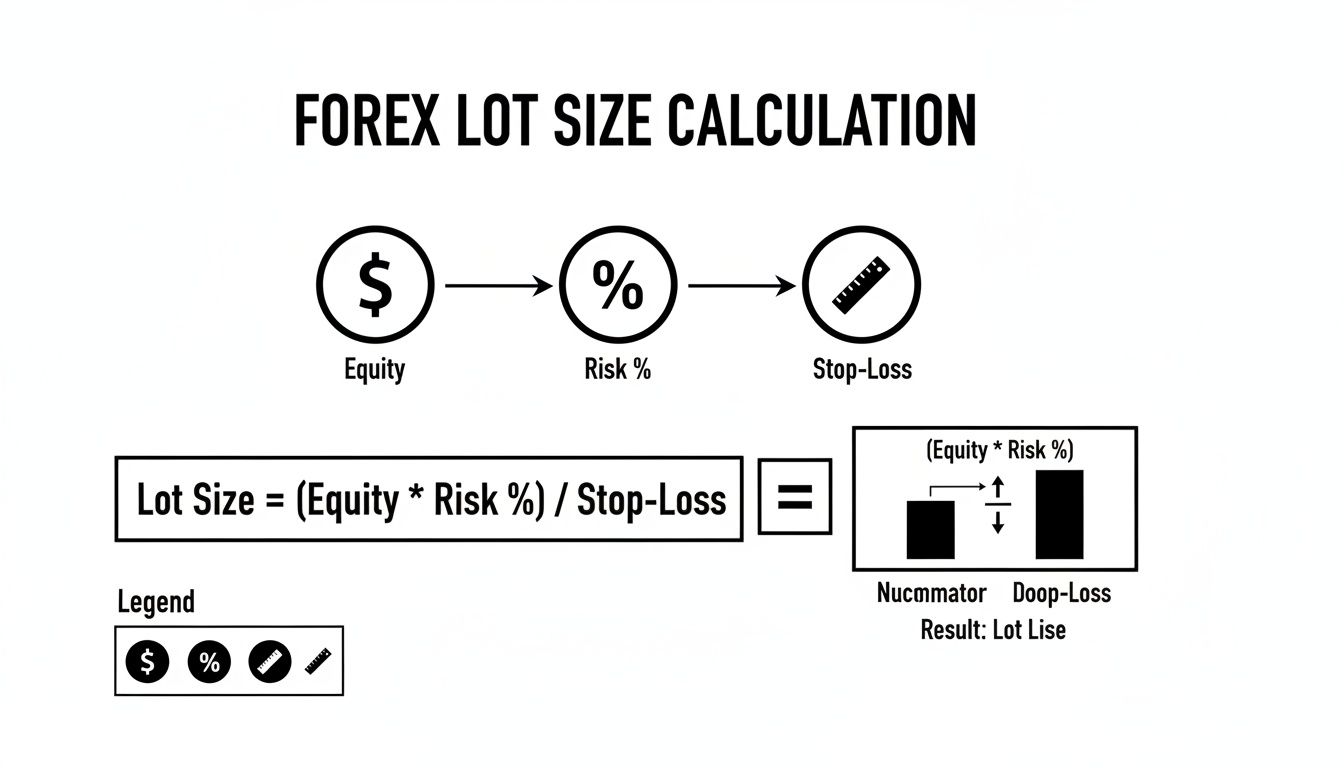

The Core Components of a Lot Size Calculation

Proper position sizing isn't complicated. It boils down to three key variables that you control.

- Account Equity: The total capital currently in your trading account.

- Risk Percentage: The percentage of your equity you are willing to risk on a single trade. A conservative and common standard is 1-2%.

- Stop-Loss Distance: The distance in pips or points from your entry price to your stop-loss level, determined by your technical analysis.

These three inputs work together in a formula to protect your capital from oversized losses. For example, if your analysis requires a wider stop-loss, the calculation will automatically result in a smaller position size to keep your dollar risk constant. This discipline is essential for navigating the strict drawdown rules of a prop firm. Our guide on risk management in forex trading digs deeper into these principles.

The Industry Standard for Risk

So, what's a reasonable amount to risk? The 1-2% rule is an industry benchmark for a reason. Most experienced traders agree that risking 1% to 2% of your account per trade strikes a healthy balance between meaningful potential gains and capital preservation.

For anyone taking on a prop firm challenge, this conservative approach is a necessity. If you stick to a 1% risk rule on a $100,000 account, you are risking $1,000 per trade. This forces you to be selective with your setups and makes it much harder to hit a 5% daily drawdown limit. You can explore the math behind these concepts at tools like MiniWebtool.

Remember: Trading is a marathon, not a sprint. The goal is to stay in the game long enough for your edge to play out over hundreds of trades. Correct position sizing is what keeps you in that game.

How the Position Size Formula Works

Every lot size calculation uses a simple but powerful formula. Understanding how it works is key to taking control of your risk management and removing guesswork from your trading.

The formula is:

Position Size = (Account Equity × Risk Percentage) ÷ (Stop-Loss Distance × Value per Point/Pip)

Let's break down each component to see how it contributes to a safe and calculated trade size.

The Ingredients of the Formula

To get an accurate result, you need to use the right inputs. Each variable represents a critical piece of information about your trade.

- Account Equity: Your real-time account balance. This number changes as you close trades, so always use the current value.

- Risk Percentage (%): The maximum percentage of your account you are willing to lose on this specific trade. Professionals typically stick to 1-2%. On a $100,000 account, risking 1% means your maximum loss is $1,000.

- Stop-Loss Distance: The space between your entry price and your stop-loss, measured in pips (for forex) or points (for indices, metals, etc.). This should be based on technical analysis, not a random number.

- Value per Point/Pip: The monetary value of a single pip or point move for one standard lot of the asset you're trading. This value differs significantly between assets like EUR/USD, Gold, and the US30 index.

The logic is simple. The first part of the formula (Account Equity × Risk %) determines your maximum acceptable loss in dollars. The second part (Stop-Loss Distance × Pip Value) calculates the potential loss per lot if your stop-loss is hit. Dividing the first by the second gives you the precise lot size to trade while staying within your risk limit.

A Practical Forex Example

Let's walk through a EUR/USD trade on a $10,000 account.

- Account Equity: $10,000

- Risk Percentage: 1% (maximum acceptable loss is $100)

- Stop-Loss Distance: Your analysis places your stop 20 pips from your entry.

- Pip Value: For a standard lot of EUR/USD, one pip is worth $10.

Now, let's use the formula:

Position Size = ($10,000 × 1%) ÷ (20 pips × $10)

Position Size = $100 ÷ $200

Position Size = 0.50 lots

The result is clear: the correct position size is 0.50 standard lots (or 5 mini lots). If the trade moves against you by 20 pips and hits your stop-loss, your total loss will be exactly $100—the 1% risk you planned for. This level of precision is non-negotiable for funded traders, where strict drawdown limits apply. You can learn more about how these standardized calculations govern trade execution in professional environments.

How to Calculate Lot Size for Different Assets

While the core formula is universal, you must adapt the inputs for different asset classes. The value of a "point" or "pip" varies widely between forex, metals, indices, and crypto, and using the wrong value can lead to dangerously oversized positions.

Let's break down how to calculate lot size with practical examples for the most common markets.

Calculating Lot Size for Forex

Forex is the most straightforward because its structure is standardized around pips and lots.

Example: GBP/USD

- Account Equity: $50,000

- Risk Percentage: 1% (maximum risk is $500)

- Stop-Loss: 40 pips from entry.

- Pip Value: For a standard lot of GBP/USD, one pip is worth $10.

Calculation:

Position Size = ($50,000 × 1%) ÷ (40 pips × $10) = $500 ÷ $400 = 1.25 lots

The correct position for this trade is 1.25 standard lots.

Calculating Lot Size for Gold (XAUUSD)

With metals like Gold, we use "points" or "ticks" instead of pips. For XAUUSD, a $1 price move (e.g., from $2,350 to $2,351) is a 1-point move. One standard lot typically means a $1 price move equals a $100 profit or loss.

Example: XAUUSD

- Account Equity: $50,000

- Risk Percentage: 1% (max risk is $500)

- Stop-Loss: $5.00 away from entry (e.g., enter at $2,350, stop at $2,345).

- Point Value: A $1.00 move per standard lot is worth $100.

Calculation:

Position Size = $500 ÷ ($5.00 stop × $100 per point) = $500 ÷ $500 = 1.00 lot

In this case, a 1.00 lot position on Gold caps your loss at exactly $500.

Sizing a Position for Indices (US30)

Indices also trade in points. For the US30 (Dow Jones), one contract often has a $1 multiplier per point.

Example: US30

- Account Equity: $50,000

- Risk Percentage: 1% (max risk is $500)

- Stop-Loss: 100 points away due to higher volatility.

- Point Value: One point is worth $1 per contract/lot.

Calculation:

Position Size = $500 ÷ (100 points × $1 per point) = $500 ÷ $100 = 5 lots (or 5 contracts)

You would trade 5 contracts of the US30 to maintain your $500 risk limit. This shows why a calculator is crucial; a 5-lot position sounds large, but the dollar risk is identical to the other examples.

Adapting Calculations for Crypto (BTCUSD)

Cryptocurrencies are highly volatile, meaning stop-losses are often much wider. For BTCUSD, one lot often represents one Bitcoin, so a $1 price move equals a $1 profit or loss per lot.

Example: BTCUSD

- Account Equity: $50,000

- Risk Percentage: 1% (max risk is $500)

- Stop-Loss: A wide stop of $800 below your entry.

- Point Value: A $1 price move is worth $1 per lot.

Calculation:

Position Size = $500 ÷ ($800 stop × $1 per point) = $500 ÷ $800 = 0.625 lots

To trade this Bitcoin setup while risking only $500, your position size would be 0.625 lots. The formula automatically reduces your size to compensate for the higher volatility.

Lot Size Calculation Examples at a Glance

This table compares these calculations on a $100,000 prop firm account with a consistent 1% risk.

| Asset | Account Balance | Risk % | Dollar Risk | Stop-Loss | Value per Point/Pip | Calculated Lot Size |

|---|---|---|---|---|---|---|

| GBP/USD | $100,000 | 1% | $1,000 | 40 pips | $10 | 2.5 lots |

| XAU/USD | $100,000 | 1% | $1,000 | $5.00 | $100 | 2.0 lots |

| US30 | $100,000 | 1% | $1,000 | 100 points | $1 | 10.0 contracts |

| BTC/USD | $100,000 | 1% | $1,000 | $800 | $1 | 1.25 lots |

Notice how the lot size changes dramatically based on the asset, even though the dollar risk ($1,000) remains the same. This is the essence of professional risk management.

Using a Lot Size Calculator on Your Trading Platform

While understanding the manual calculation is important, fumbling with a calculator during live market conditions is impractical and prone to error. Modern trading platforms have integrated tools to make this process seamless, allowing you to focus on your analysis.

Integrated Calculators in cTrader and DXtrade

Top-tier platforms build risk and position sizing features directly into their order windows, which is a major advantage for disciplined traders. Platforms common in the prop firm space like cTrader and DXtrade excel at this. For more information, see our FAQ on what trading platforms you can use.

- cTrader: The platform's advanced order ticket is very intuitive. As you set a stop-loss on the chart, the order window often shows the exact dollar amount at risk. Many versions also allow you to input your risk percentage directly, and the platform will automatically calculate the correct lot size for you.

- DXtrade: This platform provides immediate feedback by showing the potential loss in your account's currency as you set a stop-loss. This turns an abstract concept like "pips at risk" into a tangible dollar figure, which is what truly matters to your account equity.

Pro Tip: Spend time on a demo account to master your platform's order ticket. Learn how to use its risk calculator and adjust parameters. Building this muscle memory will be invaluable when you are trading live under pressure.

Standalone Online Lot Size Calculators

If your platform lacks a built-in calculator or you prefer a separate tool, there are many free and comprehensive online lot size calculators available. They allow you to input your specific trade parameters for an accurate result.

How to use one:

- Select Your Instrument: Choose the currency pair, index, or commodity.

- Enter Account Details: Input your account currency (e.g., USD, EUR) and current account balance.

- Define Your Risk: Enter your risk as a percentage (e.g., 1%) or a fixed cash amount (e.g., $500).

- Set Your Stop-Loss: Input the distance in pips or points.

- Calculate: The tool will provide the precise position size in lots and units.

Whether you use an integrated tool or an online calculator, the goal is the same: to remove emotion and guesswork from your trading by grounding every decision in solid risk management.

Aligning Position Sizing with Prop Firm Rules

When trading with a prop firm, a lot size calculator is your most important tool for compliance. Your primary goal is to stay within the firm’s strict risk parameters, specifically the drawdown limits. Most firms enforce a 5% daily drawdown and a 10% maximum drawdown. Breaching these rules means losing the account.

Staying Within the Daily Drawdown Limit

The daily drawdown is often the rule that trips up new prop firm traders. On a $100,000 account with a 5% limit, your equity cannot fall below $95,000 at any point during the day. Your risk per trade is what keeps you safe.

Let's compare risk scenarios on a $100,000 account with a $5,000 daily drawdown limit.

| Risk per Trade | Number of Consecutive Losses | Total Loss ($) | Daily Drawdown Status | Key Takeaway |

|---|---|---|---|---|

| 0.5% ($500) | 5 | $2,500 | Safe | Provides a large buffer for a losing streak. |

| 1.0% ($1,000) | 3 | $3,000 | Safe | A bad run, but you remain well within the rules. |

| 2.0% ($2,000) | 3 | $6,000 | Failed | Just three losses and the account is breached. |

A disciplined approach gives you room to be wrong and trade another day. An aggressive one can end your prop firm journey in a single bad session. For a deeper look at specific rules, you can explore the details of our funded forex trading accounts.

How Position Sizing Protects Your Max Drawdown

By pre-defining your maximum risk on every trade, you ensure that no single position can cause catastrophic damage to your account. A string of small, well-managed losses is a normal cost of doing business in trading. One oversized loss, however, can be impossible to recover from and will quickly threaten the maximum drawdown limit.

Your lot size calculator is the gatekeeper that prevents a single bad trade from ending your challenge or funded account.

Adjusting Risk Based on Performance

Smart traders are dynamic with their risk. They adjust their position size based on their current performance and proximity to drawdown limits.

- When Approaching a Drawdown Limit: If you are down 3% on the day, consider cutting your standard risk in half (e.g., from 1% to 0.5%). Your primary goal becomes capital preservation.

- After a Winning Streak: Overconfidence after a series of wins can lead to sloppy, oversized trades. Stick to your plan and continue using your calculator to enforce consistent risk. Don't let one emotional trade give back all your hard-earned gains.

Your success in a prop firm depends more on your risk management discipline than your win rate. A lot size calculator is the simple, practical tool that enforces that discipline.

FAQ: Common Questions About Using a Lot Size Calculator

What is the best risk percentage to use per trade?

For most traders, especially those who are new or trading with a prop firm, risking between 0.5% and 1% of your account per trade is a good standard. This conservative approach helps you withstand losing streaks without significant damage to your capital. Risking more than 2% is generally not advisable, as it dramatically increases your risk of ruin.

How does leverage affect my lot size calculation?

Leverage does not factor into your lot size calculation. Your calculation is based on your account equity, risk percentage, and stop-loss distance. Leverage only determines the maximum position size you are allowed to open, not the size you should open. Proper position sizing ensures you use leverage as a tool for capital efficiency, not as a way to take on excessive risk.

What if my account is in a different currency than the pair I'm trading?

This is a common scenario and a key reason why online calculators are so useful—they handle the conversion automatically. If calculating manually, you need to convert your risk amount (e.g., in EUR) to the quote currency of the pair (e.g., USD for EUR/USD) using the current exchange rate before completing the rest of the formula.

Should I adjust my lot size after a winning or losing trade?

Yes. Your position size should always be calculated based on your current account equity, not your starting balance. After a win, your equity is higher, so 1% risk will be a slightly larger position. After a loss, your equity is lower, and a 1% risk will result in a smaller position. This dynamic sizing naturally compounds your wins and reduces your risk during drawdowns.

Take Control of Your Trading Risk

You now have the knowledge to calculate your position size correctly, a skill that is fundamental to protecting your capital and succeeding in a prop firm environment. The next step is to put this knowledge into consistent action. A lot size calculator is more than a tool; it's a mechanism for enforcing discipline. It forces you to define your risk before you enter a trade, removing emotion and guesswork from the equation.

Make this a non-negotiable part of your pre-trade checklist. By doing so, you will trade with the confidence that comes from knowing you are in complete control of your risk, no matter what the market does.

Ready to apply your risk management skills in a professional trading environment? MyFundedCapital offers funding programs designed for disciplined traders.

Learn more about our funding programs and start your challenge