Struggling to grow your trading account due to limited capital is a common problem for skilled traders. Forex prop firms offer a solution by providing access to significant funding, but choosing the right one can be confusing. This guide breaks down exactly what to look for, helping you compare firms and select a partner that fits your strategy.

Trading involves a significant risk of loss and is not suitable for all investors. The content provided is for educational purposes only and should not be considered financial advice.

What Are Forex Prop Firms and How Do They Work?

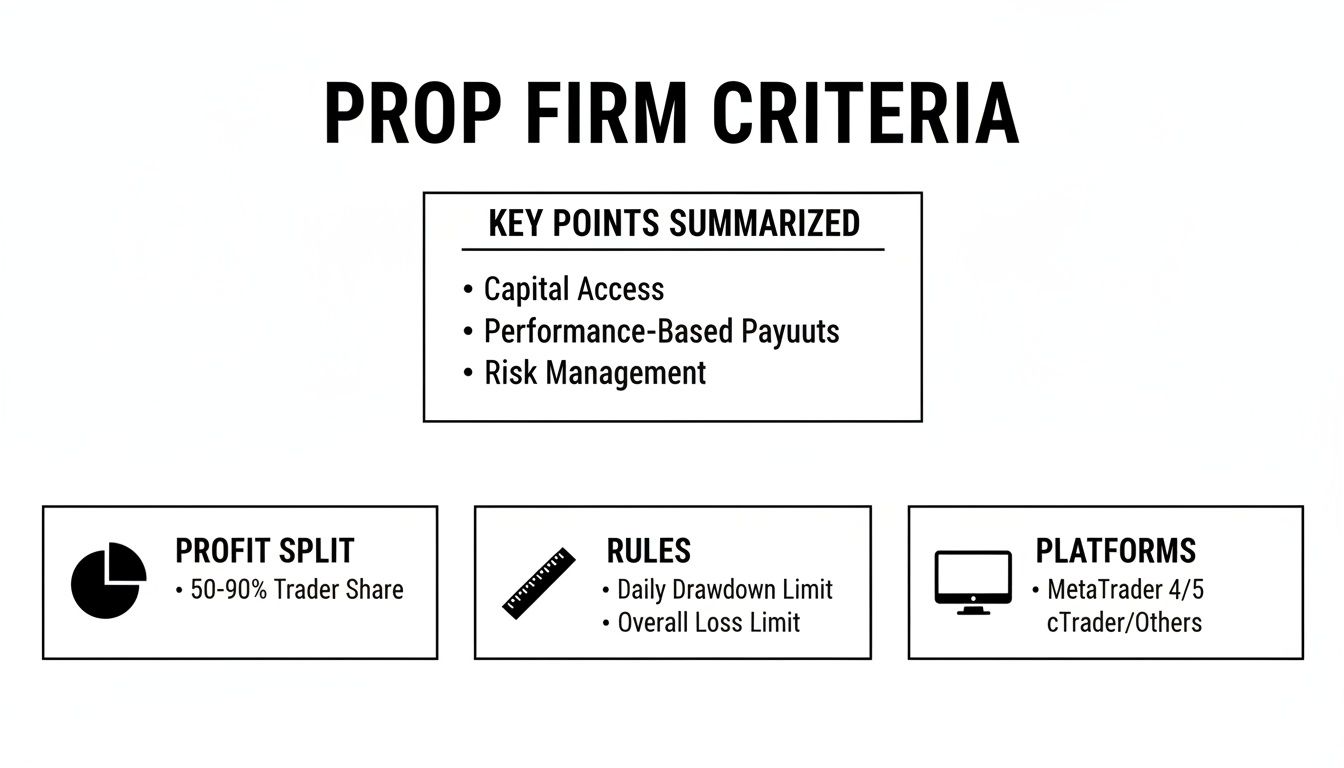

A proprietary (prop) trading firm is a company that provides its capital to traders. This creates a partnership: the firm finds talented traders to generate profits, and traders get access to large accounts without risking their own savings. Your personal risk is limited to the one-time evaluation fee, and you are not liable for trading losses.

Most online forex prop firms use an evaluation process, often called a "challenge," to verify a trader's skill and discipline before granting access to a funded account.

The Evaluation Process: A Step-by-Step Breakdown

Before a firm provides a large funded account, they need to see that you can manage risk and generate profits consistently. The evaluation is a trial period on a demo account where you must meet specific objectives.

- Profit Target: You need to reach a set profit goal, typically 8% to 10%, to prove your strategy is effective.

- Drawdown Limits: This is the most critical rule. You must not lose more than a predetermined percentage of the account. This includes a daily loss limit (e.g., 5%) and a maximum overall loss limit (e.g., 10%). Breaching these limits results in disqualification.

- Trading Period: Many reputable firms have removed time limits, allowing you to trade at your own pace without pressure to force trades.

The evaluation fee acts as a filter, ensuring that only serious traders who can adhere to risk management rules gain access to the firm's capital.

The Funded Account Stage

Once you successfully pass the evaluation, you are given a funded account. At this stage, you trade with the firm’s capital and split the profits, often keeping up to 90% of your earnings.

While you are now a funded trader, you are typically still trading on a simulated account. The prop firm uses advanced technology to replicate your trades in their own live corporate account. For a more detailed explanation, read our article on what proprietary trading firms are and how they work.

This model aligns the interests of both the trader and the firm. When you profit, the firm profits, creating a sustainable, long-term partnership. You must continue to follow the same risk rules, such as drawdown limits, to protect the firm's capital.

Understanding The Different Prop Firm Funding Models

Choosing the right prop firm involves selecting a funding model that aligns with your trading style and risk tolerance. Some traders prefer a structured, multi-phase evaluation, while others seek a faster path to a funded account. The growth of the prop trading market, projected to reach USD 14.46 billion by 2033 according to Business Research Insights, has led to a variety of models.

Let’s look at the three most common structures.

The Classic 2-Step Challenge

The 2-step challenge is the most prevalent model in the industry. It is designed to test both your ability to generate profits and your consistency over time.

- Phase 1: This phase requires you to hit a profit target of around 8% while adhering to all drawdown rules. It demonstrates that your strategy has a profitable edge.

- Phase 2: The profit target is typically lower, around 5%, with the same risk parameters. This phase confirms your ability to replicate your success and manage risk consistently.

This model is ideal for traders with a systematic approach who want a structured path to prove their skills.

The Accelerated 1-Step Challenge

For traders confident in their strategy who want a more direct route to funding, the 1-step challenge is an excellent option. It condenses the evaluation into a single phase.

The profit target is usually higher, often 10%, but once you achieve it without breaching any rules, you become a funded trader. This model suits decisive traders who want to start earning a profit split as quickly as possible.

The Instant Funding Model

Instant funding bypasses the evaluation process entirely, giving you a live-funded account from day one. It is the fastest way to begin trading with a firm's capital.

However, this model comes with its own set of trade-offs. Instant funding accounts often have stricter drawdown limits or more complex scaling plans that reward long-term consistency. This option is best for experienced traders with a proven track record. To learn more, see our guide on how prop firm instant funding works.

What Really Matters When Comparing Forex Prop Firms

When comparing forex prop firms, it's easy to get sidetracked by large account sizes and marketing claims. The key is to find a firm whose rules and structure align with your specific trading style.

Use the following practical criteria as a checklist to objectively evaluate and compare firms.

Profit Splits and Payout Schedules

Profit splits are a major draw, with firms advertising rates of 80%, 90%, or even higher. It's important to understand the conditions attached. A high split might only apply after several successful payouts or could be a paid add-on.

Equally important is the payout schedule, which affects your personal cash flow.

- Typical Payouts: Most firms offer bi-weekly (every 14 days) or monthly payouts.

- Initial Wait Time: Be aware of the waiting period for your first withdrawal, which is commonly between 14 to 30 days after getting funded.

- Payment Methods: Check for convenient withdrawal options like bank transfer or crypto.

The Make-or-Break Rule: Drawdowns

The drawdown rule is the most important parameter. If you breach it, you lose the account. There are two main types of drawdowns, and understanding the difference is crucial for your success.

- Static Drawdown: This is the most trader-friendly option. The maximum loss limit is calculated based on your initial account balance and it never changes. For example, on a $100,000 account with a 10% static drawdown, your absolute stop-out level is always $90,000.

- Trailing Drawdown: This type is more challenging. The drawdown limit "trails" your account's highest equity point. As your account grows, your stop-out level also rises, which can shrink your room for error and add psychological pressure.

A static drawdown provides a predictable risk buffer, allowing you to manage trades with greater confidence.

Trading Platforms and Allowed Strategies

Your trading platform is your primary tool, so it should be one you are comfortable with. Most firms offer the industry standards, MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Firms that also provide modern alternatives like cTrader or DXtrade demonstrate a commitment to offering professional-grade tools.

Beyond the platform, verify which trading strategies are permitted.

- Expert Advisors (EAs): Can you use automated trading systems?

- News Trading: Are you allowed to trade during high-impact economic news releases?

- Weekend Holding: Can you hold positions over the weekend?

Some firms restrict these by default but offer them as paid add-ons. If your strategy relies on any of these, confirm they are allowed before you sign up.

How to Navigate Prop Firm Rules and Avoid Common Mistakes

Passing a prop firm evaluation is a significant achievement, but keeping the funded account requires disciplined adherence to the rules. Many traders fail not because their strategy is flawed, but because they violate a specific rule. The recent industry shake-up, as detailed in the latest prop firm industry trends on financemagnates.com, has reinforced the importance of partnering with transparent firms with clear rules.

Here are actionable steps to avoid common mistakes and protect your funded account.

The Drawdown Trap: A Practical Checklist

The drawdown limit is the number one reason traders lose their accounts. One poorly managed trade can lead to disqualification.

- Actionable Step 1: Know Your Drawdown Type. Before trading, confirm if your drawdown is static or trailing. A static drawdown is based on your initial balance, while a trailing drawdown follows your highest equity point.

- Actionable Step 2: Set Personal Risk Limits. Your personal stop-loss should be well within the firm’s limits. For example, if the daily drawdown is 5%, limit your risk per trade to 1%. This creates a buffer and prevents emotional decisions.

- Actionable Step 3: Monitor Your Daily Loss. Keep a close eye on your daily performance. If you are approaching the daily loss limit, stop trading for the day to avoid a breach.

Ignoring the Fine Print on Trading Strategies

Never assume your strategy is allowed. Prop firms have specific rules to manage their overall risk exposure.

Commonly restricted strategies include:

- Martingale/Grid Systems: Strategies that increase position size after a loss are almost always banned due to their high-risk nature.

- High-Frequency Trading (HFT): EAs that execute thousands of trades in seconds are typically not permitted.

- Copy Trading: Using signals from third-party services may be prohibited.

Actionable Step: Before paying for an evaluation, check the firm’s FAQ or terms and conditions page to confirm that your specific strategy or Expert Advisor (EA) is permitted.

Overlooking News Trading and Weekend Holding Rules

Many firms restrict trading around major news events to avoid volatility and slippage. A common rule is no trading for two minutes before and after a high-impact release. Similarly, some firms prohibit holding trades over the weekend to mitigate gap risk.

Actionable Step: If your strategy involves news trading or holding positions over the weekend, choose a firm that explicitly allows it or offers it as an add-on. Build these rules directly into your trading plan.

Your Next Steps To Getting A Funded Account

You have the information needed to make an informed decision. The final step is to create a clear plan to move forward.

First, finalize your choice of prop firm by focusing on the criteria that matter most to your trading style. Prioritize features like a static drawdown, your preferred trading platform, and rules that accommodate your strategy (e.g., news trading or weekend holding).

Building Your Evaluation Plan: A 3-Step Checklist

Once you've selected a firm, strategically configure your evaluation account.

- Select an Account Size: Start with an account size that aligns with your experience and risk tolerance. A $25,000 or $50,000 account is a practical starting point to prove your skills without a large upfront fee.

- Choose a Funding Model: If you are confident in your strategy and want a faster path, the 1-Step challenge is a good choice. If you prefer a more structured process to demonstrate consistency, select the 2-Step model.

- Decide on Add-Ons: Only select add-ons that are essential to your trading plan. If you are a swing trader, the Weekend Holding add-on is necessary. If you are an intraday news trader, the News Trading add-on is crucial.

The evaluation is a test of discipline and rule adherence, not just a race to a profit target. Ensure your trading plan is fully aligned with the firm's rules from day one. Passing an evaluation is not a guarantee of future profits; it is an opportunity to showcase your skill in a professional, risk-managed environment.

Frequently Asked Questions About Forex Prop Firms

Navigating the world of forex prop firms can bring up many questions. Here are clear, direct answers to some of the most common ones.

Can I lose more than the evaluation fee?

No. With a legitimate prop firm, your maximum financial risk is strictly limited to the one-time fee you pay for the evaluation. You are trading the firm's capital, so you are not responsible for any trading losses incurred in a funded account.

Are my trading strategies restricted?

Yes, most prop firms have restrictions. Common prohibited strategies include martingale, grid trading, and certain types of high-frequency EAs. Some firms also restrict copy trading from third-party signal providers. Always read the terms and conditions or FAQ section to confirm that your specific strategy is allowed before signing up.

How quickly can I get paid?

Payout schedules vary by firm. The industry standard has been bi-weekly (every 14 days) or monthly, with an initial waiting period of up to 30 days for the first withdrawal. However, many firms now offer faster options, such as weekly payouts. Always verify the payout policy, including processing times and available withdrawal methods.

What happens if I fail the evaluation?

If you breach a rule, such as the maximum drawdown limit, the evaluation account will be terminated. The fee you paid covers that one attempt. To try again, you will need to purchase a new evaluation. Some firms may offer a free retry if you end the evaluation period in profit but haven't hit the target, provided you haven't violated any rules.

Ready to take the next step in your trading journey?

Learn about our funding programs