If you have a solid trading strategy but a small account balance is holding you back, a funded trading account could be the solution. This guide explains what funded accounts are, how they work, and how to choose the right one for your strategy. We'll cover the rules, payout structures, and the key differences between evaluation challenges and instant funding.

What Are Funded Trading Accounts and How Do They Work?

Think of a funded trading account as a partnership. A prop firm provides the trading capital, and you bring the strategy and execution. You trade in a simulated environment, and when you generate profits while following their risk management rules, you keep a large share of those profits.

This model helps talented traders overcome the biggest hurdle: lack of capital. Instead of slowly growing a small personal account, you could manage a simulated account of $100,000 or more. It's a performance-based system: prove you can trade consistently and manage risk, and you get paid a share of the profits without risking your own money.

The Two Main Paths to Funding

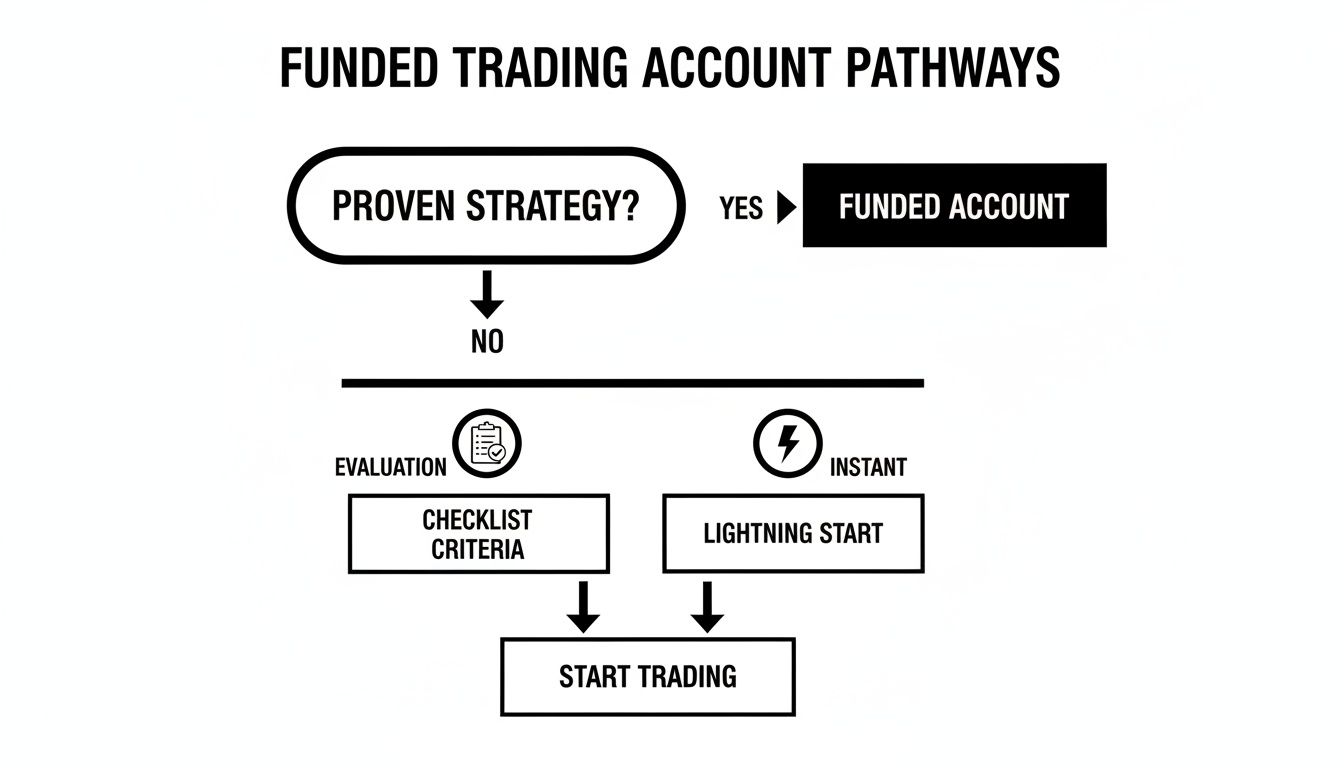

Prop firms typically offer two ways to get a funded trading account, designed for different types of traders.

- Evaluation Challenges: This is the most common route. You pay a one-time fee to take an "evaluation" on a demo account. The goal is to hit a specific profit target (e.g., 8-10%) without breaking any risk rules, such as daily or maximum loss limits. If you pass, you get access to a funded account.

- Instant Funding: This is a direct path. For a higher upfront cost, you skip the evaluation process and get immediate access to a funded account. You must operate under the same strict risk rules from your very first trade.

The remote prop trading industry has grown rapidly, driven by traders seeking access to larger capital pools on advanced platforms like DXtrade and cTrader. You can learn more about the prop firm boom to understand the market trends.

A funded account is not a "get rich quick" scheme. It's a tool for disciplined traders who have already developed a working strategy. If you can stick to the rules and manage risk effectively, a funded account can be a powerful way to scale your trading.

Choosing Your Path to a Funded Trading Account

So, you've decided a funded account is the right move. The next question is how to get one. Proprietary trading firms typically offer two main options: an evaluation challenge or an instant funding program. Neither is better than the other, but one will likely be a better fit for your experience, confidence level, and budget.

The Two Main Funding Models

The most common path is the evaluation challenge. This is a test of your trading skill. You pay a fee to trade on a demo account where the firm sets the rules and profit targets. For example, a two-phase challenge might require you to hit an 8% profit target in the first phase and a 5% target in the second, all without breaking the risk limits.

Pass the evaluation, and you've proven you can generate profit while managing risk. As a reward, the firm gives you access to a live funded account. This is a lower-cost way to get started, ideal for traders who are confident in their strategy and don't mind proving it.

The other option is instant funding. This route allows you to skip the evaluation and start trading a funded account immediately. The trade-off for this direct access is a higher upfront fee.

This option is often preferred by experienced traders with a documented history of success who want to start earning their profit split from day one. If this sounds like you, it's worth exploring the benefits of an instant funding prop firm.

The decision comes down to this: evaluation challenges are a low-cost test of skill, while instant funding is a higher-cost shortcut for traders ready to perform immediately.

This flowchart illustrates the decision-making process for a trader with a proven strategy.

Once your strategy is established, you either prove it through a challenge or pay more to start right away with an instant account.

Making Your Decision

To help you weigh the options, here is a side-by-side comparison of the two models.

Evaluation Challenges vs Instant Funding

| Feature | Evaluation Challenge (1-Step/2-Step) | Instant Funding |

|---|---|---|

| Initial Cost | Lower one-time fee (often refundable after passing) | Higher upfront fee, not refundable |

| Access to Capital | Granted after successfully passing the evaluation | Immediate access upon signup |

| Pressure | Pressure to hit profit targets within the rules | No profit targets, but must manage risk from the first trade |

| Best For | Traders with a proven strategy but a smaller starting budget | Confident, experienced traders who want to earn splits right away |

| Profit Split | Payouts begin only after you get the funded account | You start earning your share from the first profitable trade |

There is no single "right" answer—only what is right for you. If you are patient, confident in your strategy, and want to keep your initial investment low, an evaluation is a great way to demonstrate your skill. If you have a highly consistent strategy and want to start generating income immediately, the higher cost of an instant account could be a worthwhile investment.

Understanding the Rules of Prop Firm Trading

To succeed with a funded account, you must trade within a specific set of rules. These rules are not meant to be restrictive; they exist to protect the firm's capital and ensure you manage risk professionally.

Breaking a rule, even accidentally, almost always results in the termination of your account. Understanding the rulebook is just as important as your trading strategy itself.

The Most Important Risk Parameters

While specific rules vary, two are fundamental to nearly every funded account: Daily Drawdown and Maximum Drawdown.

- Daily Drawdown: This rule limits how much your account equity can lose in a single day, typically around 5%. On a $100,000 account, a 5% daily drawdown means your equity cannot drop below $95,000 at any point during the 24-hour trading day. This prevents one bad day from destroying the account.

- Maximum Drawdown: This is the absolute lowest your account equity can fall. It is the total loss allowed from your initial balance, usually set between 8% to 10%. With a 10% max drawdown on a $100,000 account, your equity can never drop below $90,000. This rule prevents a slow bleed of the account over time.

Violating either of these rules is a hard breach, which means your evaluation or funded account is closed. It is crucial to understand what constitutes a hard breach rule before placing your first trade.

These rules force you to trade like a professional risk manager. The focus shifts from simply hitting profit targets to protecting capital, which is the primary job of any serious trader.

Other Common Trading Rules and Restrictions

Beyond drawdown limits, firms have other operational guidelines. Always read the terms and conditions carefully.

Common Operational Rules:

- Minimum Trading Days: Some programs require you to trade for a minimum number of days (e.g., 5 or 10) to pass an evaluation. More modern firms are removing this rule, allowing you to get funded as soon as you hit your profit target.

- News Trading Restrictions: Due to extreme volatility, many firms prohibit holding trades during major news events. Opening or closing a position within a few minutes of a high-impact announcement could violate their rules.

- Weekend Holding: You may be required to close all positions before the market closes on Friday to avoid the risk of price gaps over the weekend.

Gaining More Flexibility with Add-ons

Some prop firms offer optional add-ons, usually for an additional fee, that allow you to customize the rules to fit your trading style.

Common add-ons include:

- Permission to Hold Trades Over the Weekend: Essential for swing traders whose strategies unfold over several days.

- The Ability to Trade During News Events: A must-have for traders whose strategies rely on news-driven volatility.

- Faster Payouts: Some add-ons can reduce the waiting time for your first payout or enable on-demand withdrawals.

These options can provide more flexibility, but the core drawdown rules always apply. No add-on can compensate for poor risk management. Success with a funded account ultimately comes down to discipline and a thorough understanding of the rules.

How Payouts and Profit Splits Actually Work

Once you have a funded account, the next step is understanding how you get paid. The payout structure is how your simulated trading performance turns into real money.

Let's break down how your profitable trades translate into a payment.

Understanding the Profit Split

The profit split is the percentage of the profits you are entitled to keep. It is the foundation of your agreement with the prop firm.

The industry standard is typically an 80/20 split, where you keep 80% of the profits you generate, and the firm keeps 20%. Many firms, including MyFundedCapital, offer add-ons that can increase your share to 90% or even 100%. This means you could potentially keep every dollar of profit you make.

Key Takeaway: The profit split is your direct compensation for skilled trading. A higher split means your success translates into more income.

Payout Schedules and Timing

It's not just about how much you get paid, but also when. Payout schedules vary between firms and account types.

Here are a few common payout structures:

- Initial Waiting Period: Most firms have a waiting period of 14 to 30 days from your first trade on the funded account before you can request your first withdrawal.

- Bi-weekly Payouts: A popular model allowing you to request a payout every two weeks, provided your account is profitable.

- 7-Day Cycles: Some firms offer weekly withdrawals after the initial waiting period.

For example, traders with Instant Funding accounts at MyFundedCapital have an initial 14-day waiting period. You can often find add-ons to shorten this time. It's important to find a schedule that aligns with your financial needs. You can review MyFundedCapital's detailed payout policies for specific examples.

A Practical Payout Example

Let's use real numbers to illustrate the process.

Imagine you are trading a $100,000 funded account with an 80% profit split. During your first payout cycle, you generate $5,000 in profit.

Here is the calculation:

- Total Profit Generated: $5,000

- Your Share (80%): $5,000 x 0.80 = $4,000

- Firm's Share (20%): $5,000 x 0.20 = $1,000

You would receive a $4,000 payout, typically via bank transfer or cryptocurrency. It is that straightforward. This simple value proposition is why skilled traders are increasingly turning to funded accounts to scale their earnings without risking their own capital.

Is a Funded Trading Account Right for You?

Funded trading programs are not suitable for everyone. They are designed for a specific type of trader: someone who already has a consistently profitable strategy but is limited by a small account size. If your primary obstacle is a lack of capital, not a lack of skill, then a funded account could be a powerful tool.

A Quick Reality Check Checklist

Before you proceed, answer these questions honestly:

- Do you have a defined trading plan? You need a repeatable process for identifying, executing, and managing every trade.

- Is your strategy profitable over time? You should have data (e.g., a track record from a personal or demo account) that proves your strategy has a positive expectancy.

- Are you disciplined with risk management? You must consistently adhere to risk parameters like stop-losses and position sizing. In a funded account, you must strictly follow the firm's drawdown rules.

If you answered "no" to any of these, it may be best to continue developing your skills on a personal or demo account. A funded account will amplify the results of your strategy—both positive and negative. It magnifies profits from a winning strategy but will also accelerate losses from an inconsistent one.

A funded account is a tool to scale a proven strategy. It is not a tool to find one.

If you have put in the work, refined your process, and have the data to prove your strategy's effectiveness, then it's time to find a prop firm whose rules and conditions align with your trading style.

Trading involves significant risk of loss and is not suitable for all investors. The content provided is for educational purposes only and should not be considered financial advice.

Frequently Asked Questions (FAQ)

What happens if I lose money? Am I responsible for the losses?

No. You are not personally liable for any trading losses incurred in a funded account. The prop firm assumes all the financial risk. Your only financial risk is the initial fee you pay for the evaluation or instant funding account. If you break a rule, the account is closed, but you will never be asked to pay back the losses.

Do I need a professional license or finance degree?

No. Prop firms are not concerned with your background or credentials. They care about one thing: your ability to trade profitably while managing risk according to their rules. The evaluation process is designed to identify skilled traders, regardless of their formal education or experience.

What happens if I break a rule?

If you violate a major rule, such as the daily or maximum drawdown limit, it is considered a "hard breach." This will result in the immediate termination of your account. While this sounds harsh, it is how firms protect their capital. Most firms will allow you to purchase a new evaluation and try again, sometimes at a discounted price.

Ready to test your strategy in a professional trading environment? At MyFundedCapital, we provide the capital and tools you need to scale your trading.

Explore our funded trading programs and find the right fit for your strategy.