Seeing a strong uptrend lose momentum can be confusing, leaving you unsure if it's a temporary pause or a major reversal. This guide will show you how to use the triple top chart pattern to identify when buyers are exhausted and a bearish trend is likely to begin. You'll learn the exact steps to spot, confirm, and trade this powerful signal.

What is a Triple Top Chart Pattern?

The triple top chart pattern is a bearish reversal formation that signals a potential end to an uptrend. It consists of three consecutive peaks at roughly the same price level, separated by two pullbacks. This repeated failure to break through a resistance level indicates that buying pressure is weakening and sellers are gaining control.

Think of it as buyers trying to break down a door three times. The first attempt is strong, the second is weaker, and by the third, they're out of energy. Once the price breaks below the support level formed by the pullbacks (the "neckline"), it confirms the sellers have taken over, often leading to a significant downtrend.

This pattern is just one of many formations that can give you an edge. You can dive deeper into other valuable structures in our complete guide to chart patterns in forex.

The Anatomy of the Pattern

To trade the triple top effectively, you need to know what you're looking for. Each part of the pattern tells a piece of the story.

- Prior Uptrend: A triple top must form after a clear uptrend. Without an existing uptrend to reverse, the pattern isn't valid.

- Three Peaks: The pattern features three distinct peaks that reach approximately the same price, creating a strong resistance zone.

- Two Troughs: Between the peaks, there are two pullbacks or troughs. These dips establish a temporary support level.

- Neckline (Support Level): This is a horizontal line connecting the lows of the two troughs. A decisive break below this line confirms the pattern.

- Volume Behavior: Ideally, trading volume decreases on the second and third peaks, showing fading buying interest. A surge in volume as the price breaks the neckline confirms strong selling pressure.

Triple Top Pattern Key Characteristics

| Component | Description | What It Signals |

|---|---|---|

| Prior Uptrend | The pattern must emerge after a sustained price increase. | Establishes the bullish context that is about to be reversed. |

| Three Peaks | Three consecutive highs at a similar price level. | Strong resistance and repeated failure of buyers to advance. |

| Two Troughs | The pullbacks between the peaks, forming interim lows. | Shows where buyers attempted to regain control but failed. |

| Neckline | A support line connecting the lows of the two troughs. | The critical "line in the sand" for pattern confirmation. |

| Volume | Tends to decrease on each peak and surge on the neckline break. | Fading buying interest, followed by aggressive selling pressure. |

The psychology here is simple but powerful. Each failed attempt to break resistance chips away at the bulls' confidence. Once the price finally cracks through the support floor (the neckline), it's like a dam breaking. It triggers a flood of sell orders, fueling the new downtrend.

How to Identify and Confirm the Triple Top Pattern

Spotting what looks like a triple top is the easy part. The real skill is confirming it properly to avoid false signals. Patience is critical; acting on an incomplete pattern is a common and costly mistake.

A 5-Step Checklist for Confirmation

Use this checklist to build a solid case for a reversal before risking any capital.

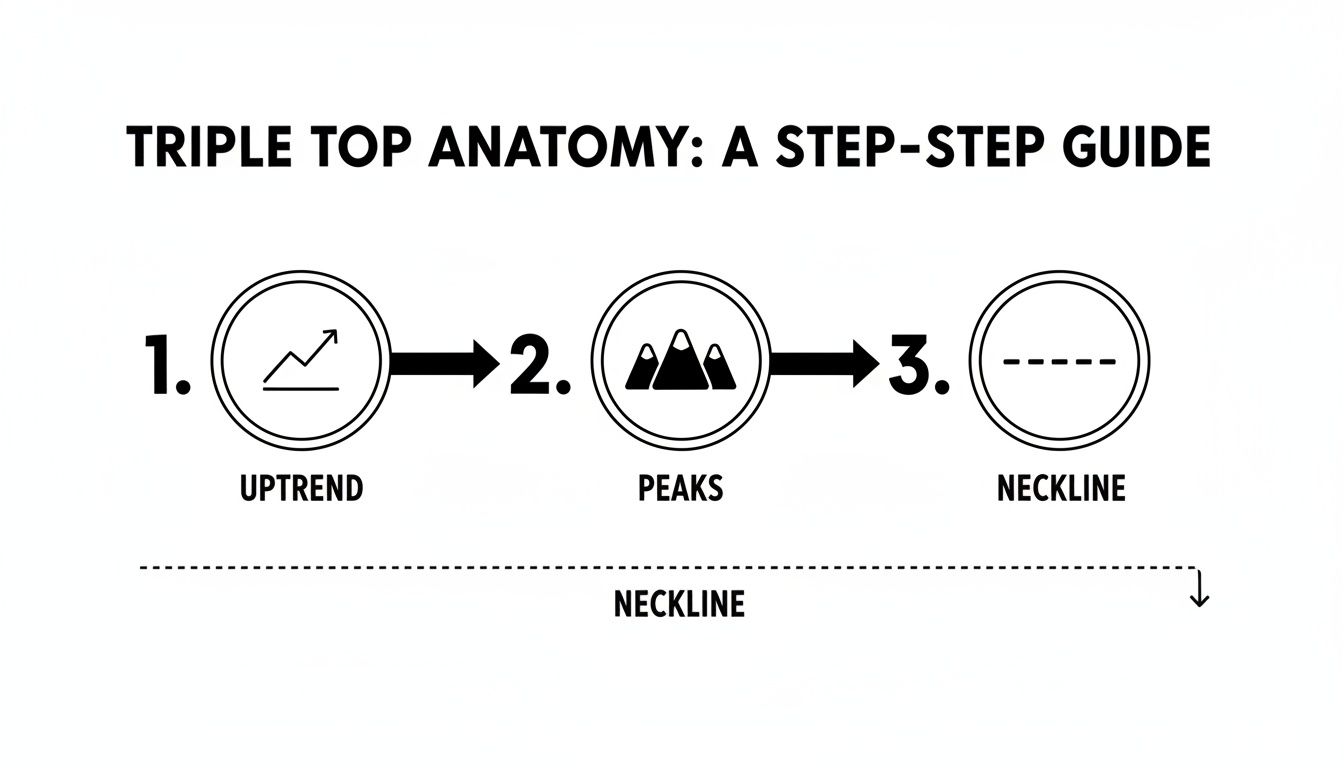

Here's a quick visual breakdown of the triple top's anatomy, from the initial rally to the final breakdown.

This flow shows how an established uptrend hits a wall, forming the three peaks and a critical support level—the neckline—that acts as the final trigger.

- Verify the Prior Uptrend: Confirm there is a clear uptrend (a series of higher highs and higher lows) leading into the pattern. No uptrend means no reversal pattern.

- Pinpoint Three Distinct Peaks: Identify three clear peaks that fail at roughly the same price level, establishing an obvious resistance zone.

- Draw the Neckline: Connect the lowest points of the two troughs between the peaks with a horizontal line. This is your critical support level.

- Analyze the Volume: Check if trading volume decreases on the second and third peaks. This suggests that buying momentum is fading.

- Wait for the Neckline Break: The pattern is only confirmed when a candle closes decisively below the neckline. Look for a surge in selling volume on the break for extra confirmation.

Crucial Insight: Acting before the neckline breaks is the single biggest mistake traders make with this pattern. It's a form of anticipation that often leads to being caught in a false signal. Patience is your greatest asset here.

The Critical Role of Volume

Volume provides insight into the strength behind price moves. A classic triple top chart pattern shows declining volume on the second and third peaks, signaling that buyers are losing conviction. When the price breaks the neckline, a spike in selling volume confirms that bears have taken control with force. This volume behavior helps filter out weaker, less reliable setups.

This concept is nearly identical to its two-peaked cousin, the double top. To get a better feel for this family of patterns, take a look at our guide on double tops and double bottoms.

Actionable Trading Strategies for the Triple Top

Once a triple top chart pattern is confirmed, you need a clear plan to execute a trade. A systematic approach helps remove emotion and manage risk effectively. Here’s how to plan your entry, stop-loss, and profit targets.

Pinpointing Your Entry Point

You have two primary methods for entering a short position after the neckline breaks.

- The Aggressive Entry (Breakout Method): Enter a short position as soon as a candle closes below the neckline. This gets you into the trade early, but carries a higher risk of being caught in a "false breakout" where the price quickly reverses back above the neckline.

- The Conservative Entry (Retest Method): Wait for the price to break the neckline and then rally back to retest the neckline from below (which should now act as resistance). Entering on this retest provides stronger confirmation and often a better risk/reward ratio, but you risk missing the trade if no retest occurs.

Setting Your Stop-Loss for Risk Management

Your stop-loss protects your capital if the trade goes against you.

Stop-Loss Placement Options

| Placement Location | Pros | Cons |

|---|---|---|

| Just Above the Neckline | Tighter stop, allowing for a larger position size and potentially better risk/reward ratio. | Higher chance of being stopped out by market noise or a sharp retest. |

| Just Above the Third Peak | More conservative, gives the trade more room to breathe, and protects against volatility. | Requires a wider stop, meaning a smaller position size and potentially a lower risk/reward ratio. |

Your choice depends on your risk tolerance and market conditions. Always calculate your risk-to-reward ratio before entering a trade; aim for at least a 2:1 ratio (potential profit is twice the potential loss).

Calculating Your Profit Target

The most common method for setting a profit target is based on the pattern's height.

- Measure the Height: Calculate the vertical distance from the highest peak down to the neckline.

- Project Downward: Subtract that distance from the neckline level where the price broke out.

- Set Your Target: The resulting price level is your minimum profit target.

Example: If the peaks are at $150 and the neckline is at $140, the pattern's height is $10. Your profit target would be $130 ($140 – $10). This provides an objective, data-driven exit strategy.

Real-World Examples of the Triple Top in Action

Theory is one thing, but seeing how the triple top chart pattern plays out on real charts is where the real learning happens. Analyzing past examples—both successful and failed patterns—helps you understand the nuances of this reversal signal.

A Textbook Example of a Triple Top

Sometimes, the market provides a perfect setup. Imagine a stock that has been in a strong uptrend. It forms three clear peaks at the same resistance level, with declining volume on each successive peak.

In this example, you can see the buying pressure weaken before the price breaks below the neckline. The breakdown is confirmed by a sharp increase in selling volume, leading to a sustained downtrend. This is the ideal scenario traders look for.

The Dot-Com Bubble: A Massive Triple Top Signal

The triple top isn't just for short-term charts; it can signal major market turning points. A famous example occurred at the peak of the dot-com bubble when the S&P 500 Index formed a massive triple top. The index made three peaks around the 1550 level between March and December 2000. When it finally broke below its neckline support near 1350 in early 2001, it triggered a multi-year bear market. You can find more at CheddarFlow's pattern analysis. This shows how the pattern's psychology applies across all timeframes.

Analyzing a Failed Triple Top Pattern

Not every potential triple top results in a reversal. Studying failed patterns is crucial for learning what red flags to watch for. A failed pattern occurs when the price breaks the neckline but then quickly reverses and rallies above the peaks.

Key Takeaway: A pattern is just a potential setup until the neckline breaks. Never jump the gun and enter a trade on an unconfirmed pattern. That's one of the quickest ways to pile up needless losses.

The most common cause of failure is a lack of volume. If the price breaks the neckline on low volume, it suggests there's no strong selling conviction. This is a major warning sign that the breakout may not be sustainable. Strict confirmation rules are your best defense against these false signals.

Common Mistakes to Avoid When Trading This Pattern

Avoiding common pitfalls is just as important as knowing the strategy. Even a perfect setup can lead to a loss if you fall into one of these classic traps.

Acting Before the Neckline Breaks

This is the most common mistake. Eagerness to get in early leads traders to short the market before the pattern is confirmed.

- Why It's a Mistake: Until the neckline is broken, the uptrend is still technically intact. The price could easily find support and rally to new highs.

- Solution: Wait for a candle to close firmly below the neckline. Patience filters out low-probability setups.

Ignoring the Importance of Volume

Focusing only on price action and ignoring volume is a critical error. Volume confirms the story that the price is telling.

- Why It's a Mistake: Declining volume on the peaks signals weakening buyers. A strong volume surge on the neckline break confirms seller conviction. Without these volume cues, the pattern is less reliable.

- Solution: Always integrate volume analysis into your checklist. A breakout on low volume is a red flag.

Setting Your Stop-Loss Too Tight

Placing a stop-loss too close to your entry point to improve the risk/reward ratio can backfire.

- Why It's a Mistake: Markets are volatile. Prices often retest broken levels, and a tight stop can get triggered by normal market noise before the real move happens.

- Solution: Place your stop at a logical structural level, such as above a recent swing high or, more conservatively, above the third peak. Learn more in our guide to risk management in forex trading.

Frequently Asked Questions

Here are answers to some common questions about trading the triple top pattern.

What is the difference between a triple top and a double top?

A double top shows two failed attempts to break resistance, while a triple top shows three. Because the triple top represents a more prolonged and decisive failure by buyers, it is generally considered a more reliable and powerful bearish reversal signal.

How reliable is the triple top pattern?

No chart pattern is 100% accurate. However, when all confirmation criteria are met (clear uptrend, three peaks, declining volume, and a high-volume neckline break), the triple top is considered a reliable reversal pattern with historical success rates often cited in the 65-75% range. Its reliability depends heavily on disciplined execution and risk management.

What is the best timeframe to use?

The triple top can appear on all timeframes, from 5-minute charts to weekly charts. Patterns on higher timeframes (daily, weekly) are more significant and typically lead to longer, more substantial trend reversals. Patterns on lower timeframes are more common but are also more susceptible to market noise and false signals.

Can I use other indicators with this pattern?

Yes, using other indicators for confluence is highly recommended. A great technique is to look for bearish divergence on an oscillator like the Relative Strength Index (RSI). If the price makes a third peak at the same level as the previous ones, but the RSI makes a lower high, it signals weakening momentum and adds strong confirmation to the bearish outlook.

Ready to Apply Your Knowledge?

You now have a practical framework for identifying and trading the triple top pattern. However, true skill comes from practice and disciplined application. Remember that all trading involves a substantial risk of loss and this content is for educational purposes only, not financial advice.

A great way to build confidence is by testing your skills in a risk-free environment. Our funding challenges allow you to trade with firm capital and prove your abilities without risking your own money.

Ready to take the next step in your trading journey? At MyFundedCapital, we provide talented traders with the capital and support they need to succeed. Explore Our Funding Programs and start your challenge today.