Wondering what PNL means and why every trader is obsessed with it? PNL stands for Profit and Loss, and it's the single most important metric for measuring your trading performance. This guide breaks down exactly what PNL is, how to calculate it, and how to use it to make smarter trading decisions, especially in a prop firm challenge.

What PNL Really Means for a Trader

At its core, PNL is your trading scorecard. It’s the final number that tells you, in no uncertain terms, whether your strategies are making or losing money. A positive PNL means you're in profit; a negative one means you're in a loss.

For a trader, especially one in a prop firm, PNL is everything. It's the primary yardstick firms use to judge your skill, discipline, and risk management. Passing a funding challenge and managing a funded account isn’t about hitting a few lucky trades—it’s about your ability to generate a consistent, positive PNL while keeping your losses under control.

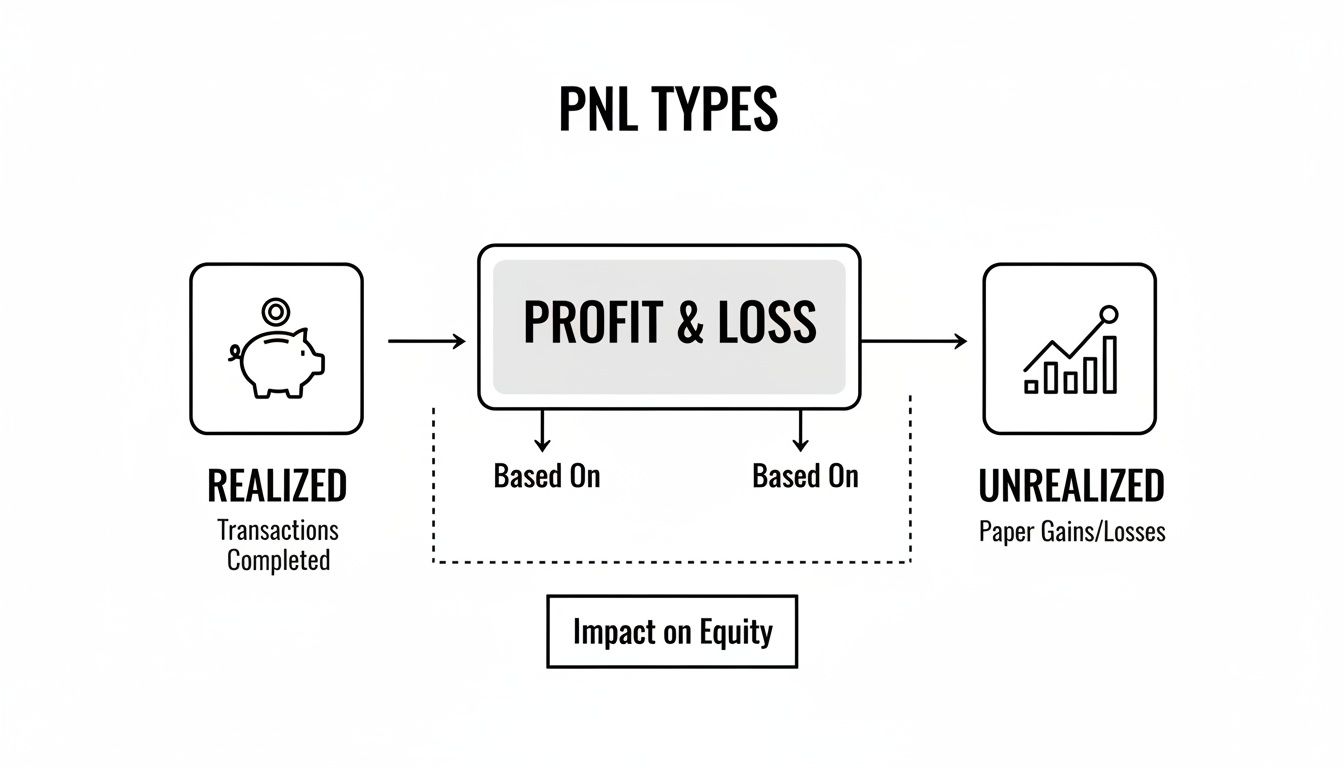

To use PNL effectively, you need to see it not as a single number, but as a concept with different components. Understanding the nuances between realized, unrealized, gross, and net PNL is what separates amateurs from professionals. It’s how you make smart decisions, refine your strategy, and manage risk—all essential skills for surviving in the trading world. Keep in mind that trading always involves a significant risk of loss and this content is for educational purposes only, not financial advice.

Calculating Your PNL: The Step-by-Step Formulas

Knowing your PNL isn't just for reviewing past performance; it’s for making better decisions on your next trade. Calculating your profit and loss is a core skill for any trader, and the math is simple.

Mastering your PNL is the bedrock of success in proprietary trading, a rapidly growing field. You can read more about the rise of prop trading among young traders on Business Insider.

The Basic PNL Formula

To calculate your profit or loss, you only need three pieces of information: your entry price, your exit price, and the size of your position. The formula is slightly different for buying (long) versus selling (short).

- For Long Trades (Buying): PNL = (Exit Price – Entry Price) x Position Size

- For Short Trades (Selling): PNL = (Entry Price – Exit Price) x Position Size

Example: Let's say you go long on the EUR/USD forex pair. You buy 1 standard lot (100,000 units) at an entry price of 1.0750. Later, you close the trade at an exit price of 1.0780.

Using the formula: (1.0780 – 1.0750) x 100,000 = $300 Profit.

Gross PNL vs. Net PNL

That $300 figure is your Gross PNL—the raw outcome of your trade before costs. To find your actual profit, you need to calculate your Net PNL.

- Net PNL is your Gross PNL after subtracting all trading costs, like commissions, swaps, and spreads. It's the number that truly matters.

Let's finish our example. If the commission on that EUR/USD trade was $7, your actual Net PNL would be $293 ($300 – $7). In a prop firm challenge, this is the number that counts towards your profit target and against your drawdown limits.

Realized vs. Unrealized PNL: What Every Trader Needs to Know

Not all profit is the same. A common mistake new traders make is seeing a large green number on an open trade and thinking of it as money in the bank. This is where the crucial distinction between realized and unrealized PNL comes in.

- Realized PNL: Profit or loss from closed trades. This is locked in and has been added to or subtracted from your account balance.

- Unrealized PNL: The current, floating profit or loss on your open trades. It’s often called "paper profit" and changes with every tick of the market.

Why This Matters for Funded Traders

This distinction is fundamental to your survival in a prop firm environment. A huge unrealized profit feels great, but celebrating too early is a recipe for disaster. That profit isn't yours until you close the position.

Your unrealized PNL directly impacts your account equity in real-time. A large floating loss on an open position can trigger your daily or maximum drawdown limit, failing your challenge even if you never officially "closed" the losing trade. This means managing your floating PNL is non-negotiable. You must be disciplined enough to protect paper profits and ruthless enough to cut paper losses before they become real ones.

Knowing where to find both figures on your trading platform is essential. To see how this is displayed on our dashboard, you can learn how to track the progress of your account.

Why PNL Is Everything in Prop Firm Challenges

In a prop firm challenge, your PNL is your entire report card. Prop firms use it to judge your trading skill, discipline, and ability to manage their capital. Your success or failure comes down to how your PNL performs against two critical limits.

The Two Pillars: Profit Targets and Drawdown Limits

The entire prop firm challenge is a game built around your PNL. Your mission is to prove you can grow an account while protecting it from significant losses.

- Profit Target: This is the minimum positive PNL you must achieve to prove your strategy is profitable. For instance, on a $100,000 challenge, you might need to generate $10,000 in net PNL.

- Drawdown Limit: This is the maximum loss the account can sustain before you automatically fail. It's the firm’s way of ensuring you don’t gamble their capital away.

Both realized and unrealized PNL affect these rules.

As the diagram shows, closed trades result in realized PNL. But your unrealized PNL from open trades is a moving target that can still violate your drawdown limit.

This laser focus on PNL is why successful prop traders are masters of risk management. Statistics show that evaluation pass rates are a slim 5-10%, according to the 2025 Prop Insight Report. The real challenge isn't hitting a home run to reach the profit target; it's proving you can consistently make profits without ever violating the drawdown rules. Steady, positive PNL with small, controlled losses is what gets you a funded account.

To dive deeper into the rules, check out our guide to understanding the prop firm challenges.

Actionable Steps to Monitor and Improve Your PNL

Improving your PNL isn't about finding a secret indicator; it's about building disciplined habits and treating trading like a business. Here are practical steps you can take to improve your performance.

1. Maintain a Detailed Trading Journal

Your trading platform provides the numbers, but a journal tells the story behind them. For every trade, log more than just the entry and exit.

- Document Your "Why": What was your reason for entering the trade? Was it technical analysis, a fundamental catalyst, or both?

- Track Your Emotions: Be honest. Were you feeling confident, fearful, or greedy? This helps you spot emotional patterns that hurt your account.

- Review and Reflect: Set aside time each week to review your journal. Identify what worked, what didn't, and why. This is where real learning happens.

2. Systematically Review Your PNL Reports

The PNL reports on your trading platform are a goldmine of objective data. Don't just glance at the final number. Dig into the details to find patterns.

- Are you more profitable during a specific session?

- Do you consistently lose money on a particular asset?

- Does your PNL curve look like a steady climb or a rollercoaster? A volatile curve is a red flag that your risk management needs work.

This review turns your PNL from a simple score into a powerful diagnostic tool.

3. Prioritize Risk Management Above All Else

You can’t control the market, but you can always control how much you stand to lose. A positive PNL over the long term is impossible without solid risk management.

- Define Your Risk Per Trade: Never risk more than a small, predefined percentage of your capital on one idea. A common rule of thumb is 1%.

- Set Strict Stop-Losses: Every trade needs a non-negotiable exit point if the market moves against you.

- Establish a Daily Loss Limit: Decide on a maximum PNL loss you're willing to accept for the day. If you hit it, you're done. This is the best defense against revenge trading.

For a more detailed breakdown, check out our guide on forex risk management strategies.

PNL FAQ: Your Common Questions Answered

Here are answers to a few of the most common questions traders have about profit and loss.

What is the difference between PNL and equity?

PNL is your performance scorecard—the profit or loss from your closed trades over a specific period. Equity is the real-time value of your entire account, calculated as your balance plus or minus the unrealized PNL from any open trades. Your PNL from closed trades is fixed, while your equity fluctuates with the market.

Do trading platforms calculate PNL automatically?

Yes, all modern trading platforms like DXtrade and cTrader calculate your PNL for you. They display both your realized (closed) and unrealized (open) PNL on your dashboard, giving you a real-time view of your performance without any manual math.

How does my unrealized PNL affect my drawdown?

This is critical for prop firm traders. Drawdown limits are almost always based on your account equity, not just your balance from closed trades. This means a large floating loss (negative unrealized PNL) on an open position can push your equity below the drawdown threshold and cause you to fail a challenge, even if you haven't closed the trade. Managing your open PNL is just as important as the final result of your closed trades.

Ready to Test Your PNL Management Skills?

Understanding PNL is one thing, but applying that knowledge under pressure is what separates successful traders from the rest. The real test is proving you can generate consistent profits while managing risk.

If you have a solid grasp on calculating, tracking, and interpreting your PNL, a prop firm challenge is the ultimate arena to prove it. These evaluations are designed to see if you can manage PNL like a professional, rewarding those who can balance profit targets with strict drawdown rules.

Remember, trading involves a significant risk of loss and is not suitable for all investors. This guide is for educational purposes only and should not be considered financial advice. Past performance is not indicative of future results.

Think you have what it takes to manage PNL like a pro? Explore the funding programs at MyFundedCapital to find an account that matches your trading style. Compare our account types today.